Both stocks and bonds are cores pieces of an investment portfolio. However, understanding how bonds work isn’t easy. It often remains a mystery for many investors. In this continuation entry, we’ll review the impact of interest rates in bonds. We’ll also explore risks associated with bonds and how bonds trade.

Bonds and holding period

You know from the first part of how bonds work that bonds have a maturity. At maturity, investors get back the face value of the bond. The life of the bond is over.

You can do two things when you buy a bond. Either you hold it until maturity, or you sell it before it matures. What should you expect in either case?

There are no surprises with bond returns…

I’ll remind you of our old friend, the yield to maturity (YTM). We saw that the YTM is the annualized return that an investor receives if (s)he holds the bond until it matures. If you hold a bond until it matures, your yearly return will be the YTM. So far, so good. You know the returns of a bond in advance.

… unless you don’t hold them to maturity

The key condition for the YTM to be your annualized returns is to keep the bond until it matures. What if you don’t? What happens if the bond has a maturity of 10 years and you decide to sell it after 3? The story is then different. If you sell a bond before it matures, an annualized return equal to the YTM is no longer guaranteed. You might make a bigger return. Or a smaller one. You can also make a loss.

What does your return depend on? Well, it surely depends on the price of the bond upon sale. And what does the price of a bond depend on? It depends on interest rates. And interest rates change all the time. Supply & demand, inflation expectations or central banks all influence interest rates. You can’t control them.

The inverse relationship between price and interest rates

Intuitively, you might assume that high interest rates are good for bond prices. But this isn’t true. In fact, there’s a negative relationship between interest rates and the value of bonds. When interest rates go up, the price of a bond goes down. And vice-versa.

We saw that interest rates and bond yields (including YTM) are pretty much the same thing. So we can also say that when the YTM of a bond goes up, its price goes down. And vice-versa. The two statements in bold are equivalent. Don’t let the terminology confuse you.

This might be confusing. Why do prices go down when yields go up? We’ll look at it in three different ways: intuitively, mathematically and visually.

The intuition

Assume that you bought a 10-year bond for $850. At the time of purchase, its YTM was 2%. Now imagine that, a few weeks later, interest rates go up. When rates go up, YTM of bonds go up as well. And a new series of 10-year bonds yields 3% instead. Who would like to have the crappy 2% bond anymore? No one! There’s now a better alternative! So what do you think happens to the value of your 2%-yielding bond? Isn’t it fair to assume a decrease in value? It is. The price of your bond will go down. It’s now less worthy.

The math

Do you remember how we value a bond? We simply add up all discounted cash flows. We’ll bring back the example we used in part one:

| Date | Year 1 | Year 2 | Year 3 |

|---|---|---|---|

| Cash flow | 20 | 20 | 1,020 |

| Interest rate | 0.41% | 1.01% | 1.57% |

| Discounting factor | (1 + 0.0041)^1 | (1 + 0.0101)^2 | (1 + 0.0157)^3 |

| Discounted cash flow | ~20 | ~20 | ~973 |

What happens when interest rates go up? The discounting factors get bigger. And since discounted cash flow = cash flow / discounting factor, the discounted cash flow gets smaller. This implies that when interest rates go up, the value of a bond decreases. Math and intuition check out!

The visual

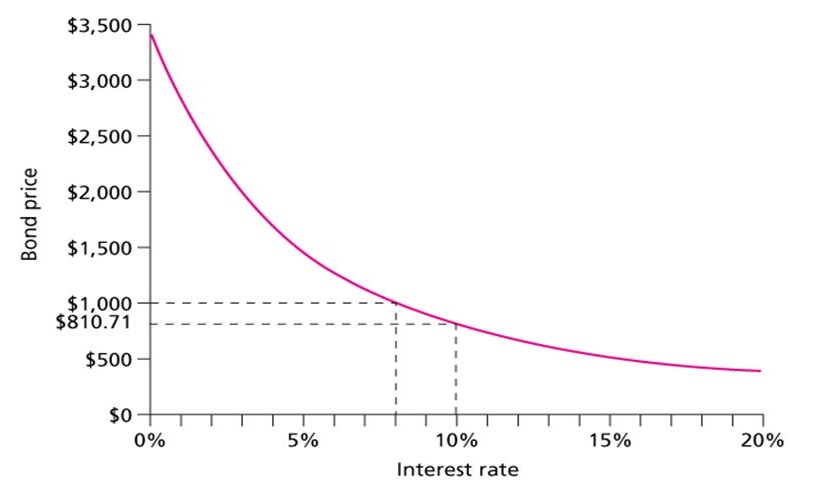

The pic below illustrates the relationship between interest rates and the price of a bond. Specifically, it shows the price of a 30-year, $1,000 principal, 8% coupon bond for a range of interest rates (equivalent to YTM). The curve has a negative slope because of the negative correlation between yields and prices.

Notice how the price of the bond is equal to the face value ($1,000) when the YTM is equal to the coupon rate (8%). This is a neat property of bonds.

The bottom line

We’ve looked at the relationship between price and yields in three different ways. This is what you have to remember:

- Knowing the price of a bond is the same as knowing its YTM, and vice-versa. One gives the other, assuming that you know the bond’s coupon and maturity

- When the YTM goes up, the price of a bond goes down. And vice-versa. Because the YTM moves together with interest rates, the statement is valid for interest rates as well

Interest rate risk

Interest rate risk is the change in value of your bonds when interest rates change [1]. By now you understand how this works. When interest rates go up, the value of your bonds go down. And vice-versa.

No bond out there is risk free. Even short-term government bonds, which are considered the safest, have interest rate risk. How can you mitigate interest rate risks? The easiest way is to hold bonds until maturity. If you hold to maturity, your annualized return will be the YTM.

Sometimes, however, your investment horizon might differ from the time to maturity. How do you control interest rate risks? This is when duration joins the scene.

Duration

What is the duration of a bond?

Duration is a key metric to measure interest rate risks. The duration of a bond measures how sensitive the value of the bond is to changes in interest rates. The higher the duration, the more the price will drop if interest rates rise. And the more the price will rise if interest rates sink. Like maturity, duration is measured in years. Duration is always less or equal than time to maturity.

What does duration tell you?

Mathematically, the duration of a bond gives an approximation of the percentage change in the price of a bond to a 1% change in interest rates [2]. For example, consider a 10-year bond. Its price is $970. And it has a duration of 7.8 years. If interest rates increase by 1%, we expect the bond to decrease in value by 1% * 7.8 = 7.8%. Or from $970 to $894. Similarly, if interest rates decrease by 0.75%, we expect the bond to appreciate by 5.9% to $1,027.

This approximation works well for small changes in interest rates. It becomes less accurate as interest rate changes get bigger.

How does duration help mitigate interest rate risks?

We’ve seen that duration is a measure of interest rate risk. You can even use it to estimate price changes based on yields changes. But there’s more to it. You can also understand duration as the holding period at which you are indifferent to interest rate changes. Value losses because of rising interest rates are offset by more lucrative reinvestments. And value gains because of falling interest rates are offset by less lucrative reinvestments.

If you align the duration of your bond portfolio with your investment horizon and reinvest the coupons, you’ll be indifferent to changes in interest rates. Being indifferent to interest rate changes is a pretty solid strategy.

YTM and changing interest rates

Time for some advanced considerations. You know very well by now that the YTM is the annualized return that an investor receives if s(he) holds the bond until it matures. What you probably don’t remember is some fine print we saw in the first part of the entry. An assumption that goes into the YTM is that you reinvest all coupons at a yield equal to the YTM.

If interest rates change, this assumption might not be realistic. If yields go up, you can probably reinvest at a higher yield than the original YTM. This is results in a true annualized yield slightly higher than the YTM. The opposite happens if yields went down.

Your annualized return will be slightly higher /lower than the YTM if you:

- Hold a bond to maturity

- Are in an environment of rising / falling interest rates

- Reinvest all coupons

This clarification might seem out of place, but it’s necessary for you to understand the next section.

Duration and annualized returns – an example

Let’s bring back our previous example. 10-year bond trading at $970 with a duration of 7.8 years. Its YTM is 3%. Say you buy it, and immediately after interest rates increase by 1%. The price of the bonds drops to $894. Bummer. What happens next?

- If you sell before 7.8 years, your annualized return will be lower than 3%. Whatever you do

- If you sell at exactly 7.8 years, and assuming you reinvested all coupons at the new higher rate of 4%, your annualized return will be the original YTM of 3%

- If you sell after 7.8 years, and assuming you reinvested all coupons at the new higher rate of 4%, your annualized return will be higher than the original YTM of 3%

- If you hold to maturity and reinvest all interests at the original YTM, your annualized return will be the YTM. This case is not very realistic because interest rates changed

- If you hold to maturity and reinvest all interests at the new higher rate of 4%, your annualized returns will be higher than the original YTM of 3%

These fives cases might confuse you at first. But it’s crucial to understand them if you want to invest in bonds. Otherwise you won’t be in a position to manage interest rate risks. And all bonds have interest rate risk.

How do I calculate the duration of a bond?

You don’t. Calculating duration is basic arithmetic, but still time-consuming and prone to error. Someone else will have calculated it for you already. Most likely an automatic algorithm. Same as the YTM, you’ll simply find it available when you need it. If you truly want to know how to calculate it yourself, check this out.

What factors affect duration?

The duration of a bond is higher the further in the future you receive cash flows. The two main factors that affect the timing of cash flows are the time to maturity and the coupon rate:

- The longer the maturity, the higher the duration

- The higher the coupon rate, the shorter the duration

Credit risk

Interest rate risk is one of the risks bondholders face. But it’s not the only one. The second most important type of risk is credit risk.

What is credit risk?

Credit risk is the probability of a loss from a borrower’s failure to repay his debt [3]. It’s basically the risk of you not seeing your money back. Unlike interest rate risks, credit risk doesn’t affect all bonds. It depends on the issuer of the bond.

What’s the impact of issuers on credit risk?

The main issuers of bonds are government and companies (corporates).

In the case of government bonds, the payment of coupons and the repayment of principal is guaranteed by the government. This is as safe as an investment can get. At least if the government is serious. And the Swiss government is serious. So are the US, German, French etc. In theory, governments could print more money to repay their debts.

Corporate bonds are different. You’re loaning money to a company. And companies might go bankrupt much more easily than governments. Companies can’t print money after all. Because of that, corporate bonds are in general riskier than government bonds.

How do you measure credit risk?

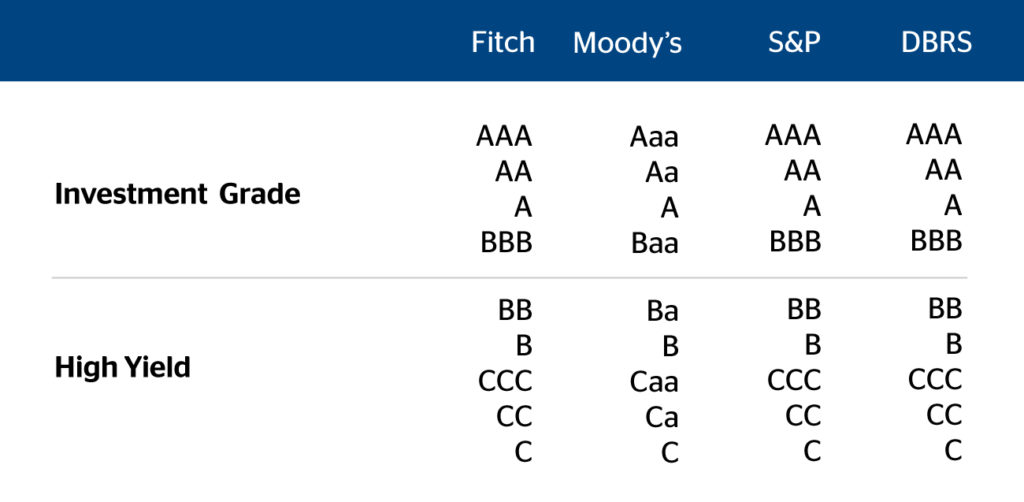

Credit ratings are a good measure of credit risk. Rating agencies such as Moody’s, S&P and Fitch create and maintain such credit ratings. Without getting into much detail, they assess securities on their probability of default. Default means not being able to make the promised payments. The probability of default depends mostly on the financial stability of the issuer.

Investment grade bonds are bonds from good issuers. Investment grade bonds are likely to be repaid. Bonds from bad issuers are labelled as junk (or high yield, or speculative).

How does credit risk affect the YTM of a bond?

You – and all other investors – prefer bonds with lower chances of default. To be competitive, bonds with worse credit quality must offer better yields. These higher yields compensate for additional credit risk. This means that, in general, junk bonds have a YTM higher than investment grade bonds. They’re called high yield for a reason after all. As a serious investor, be 100% you know what you’re doing before buying any junk bonds.

A word of caution on rating agencies

Credit rating agencies are the only players out there systematically assessing credit risks for thousands and thousands of financial products. They provide valuable information. But they are not infallible. Rating agencies have been associated to a number of scandals. Most notably to the 2008-2009 subprime mortgage crisis [4]. In essence, critics argue that they gave certain financial products much higher ratings than they deserved. And so they enabled the financial meltdown.

More generally speaking, you should take credit ratings with a grain of salt because:

- Credit ratings lag actual performance: agencies can only update their ratings so often, but the performance of a company changes on a continuous basis

- Assessing risks is difficult: holistically considering all risks that affect a specific company or industry isn’t easy. Nobody – not even rating agencies – can perfectly weigh in all internal and external factors

- Rating agencies might not have the right incentives: it’s normally the issuer of a financial product who pays agencies to assign a rating. Any actual bias would be difficult to prove, but you get the point

How bonds trade

Unlike stocks, bonds are not sold in centralized exchanges. As we saw in this entry, you like exchanges as an investor. Exchanges make it easy to trade and bring transparency.

How do bonds trade, then? Bonds trade over-the-counter (OTC). As an investor, you don’t like OTC trading. It requires trading through dealers, which is out of reach most most retail investors, including you and me. Even if you could trade through dealers, you wouldn’t like to do that. Dealers add fees and remove transparency.

Luckily, there’s and alternative: bond ETFs. We’ll talk about them in a future entry.

Closing and what’s next

You’ve come a long way! You now understand how bond works. Coupons, maturity, face value, yield to maturity, yield curves, duration, interest rate risk, credit risk. You name it. Even more importantly, you’ve hopefully gained intuition around the following topics:

- When you should consider investing in bonds

- Why you care most about the yield to maturity

- How yields and prices are negatively correlated

- The two main types of risks around bonds: interest rate risk and credit risk

- How duration can help you control interest rate risks

You might find the previous section a bit of a bummer. I mean, we’ve come all this way just to realize that bonds don’t trade like stocks? That you can’t invest in bonds? As anticipated, there’s a workaround: bond ETFs. Investing in bond ETFs is not the same as investing in bonds. For example, bond ETFs never mature. How do you take that? Stay tuned for the next entry.

Last updated on May 18, 2020