Almost there! This is the closing theme of the tax declaration guide (and of the tax filing process). It literally deals with ‘closing’ (Abschluss). Most likely you won’t have much to do here.

Overseas taxes

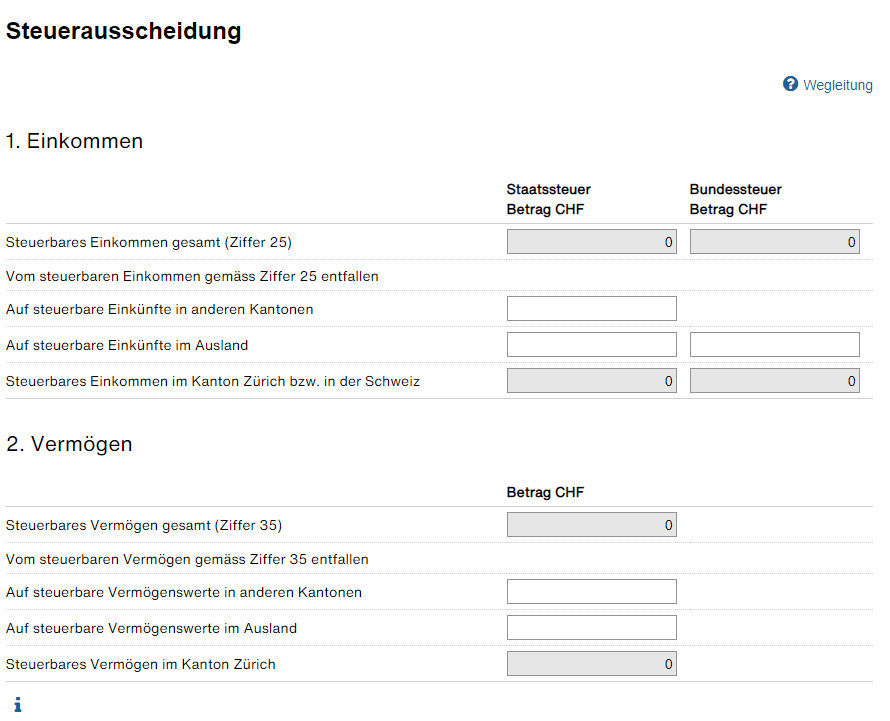

Steuerausscheidung

Let’s first clarify the title of this form. Ausscheidung seems to be a technical term that describes the tax split that takes place when a tax payer is levied taxes by multiple cantons or countries.

You can use this form for two purposes:

- Validate the aggregated figures for your taxable income and taxable wealth. Make sure the totals are in the range you’d expect. These are the fields Steuerbares Einkommen and Steuerbares Vermögen. Typical mistakes such as double-counting securities in the DA-1 form are easy to spot here

- Indicate any overseas income or assets. This can be either domestic (other cantons) or foreign (other countries). The tax authorities will use this info to ‘distribute’ taxes in a fair way

General guidelines on the Ausscheidung

In general, natural persons are only taxed where they live. However, certain sources of income or assets are taxed locally. If you have a property in France, you’ll likely have to pay taxes for it in France. If you earn a side income in Italy, you’ll likely pay taxes on it in Italy.

Generally speaking, the Swiss tax authorities won’t tax you on overseas income or assets. However, foreign income or wealth can result in higher tax rates in Switzerland.

Imagine for example you declare real estate abroad. You won’t be taxed on by the Swiss tax office. But the value of the property will be considered to determine your Swiss wealth tax rate. This affects other assets in Switzerland [1].

Remarks

Bemerkungen

Any remark you want the tax office to read goes here. Are there any unique circumstances affecting your tax declaration? Maybe it’s a good idea to share them. I’ve personally always left it blank.

Supplementary documents

Beilagen

Here you can check all docs you’ve uploaded to the tax filing. As a non-exhaustive list, most people likely should find here:

- Salary certificate (Lohnausweis). We talked about this both in the themes income and deductions. Individual payslips are not required

- Health insurance premiums (Krankenversicherungsprämien)

- Pillar 3a contributions (Beiträge Säule 3), if applicable

- Broker extracts listing your securities (Wertschriftenverzeichnis), if applicable

- Broker extracts for DA-1 form (DA-1 Wertschriften), if applicable

Submission

Einreichen

Verify that you pass all automatic checks to submit (Daten validieren), keep a PDF copy of the tax declaration for your records and submit!

Closing

That’s it! If you made it here, you’ve completed your tax declaration. If this is your first time, the process was likely long. Don’t worry, next year it’ll only take a fraction of the time! I hope that you found this guide helpful. And also to see you next year!

Themes in the tax declaration guide

- Persönliches (personal data)

- Einkünfte (income)

- Abzüge (deductions)

- Wertschriften (securities)

- Vermögen (wealth)

- Abschluss (completion)

Last updated on March 13, 2021

4 replies on “Tax declaration guide (6/6): Abschluss”

Many thanks, you built a detailed,acccurate and understandable guide for what I was trying to complete for ~2 days now. Kudos to you !

Thank You very much! Your guide is really helpful and it answered many question, what I could not find anywhere else.

AMAZING article, I wish I stumbled upon it before I started filling the form, I’d save so much time.

Thanks for this super useful and still used guide 🙂