The fourth theme in the tax filing process deals with securities (Wertschriften). Both securities and cash in bank accounts belong here. This means pretty much everybody has something to declare in this theme. We’ll cover all forms in detail as part of the tax declaration guide.

What you declare under Wertschriften potentially makes you liable for both income and wealth taxes. I’d suggest to have a look at this to learn more about the general framework around such taxes in Switzerland. It’s not required knowledge to file your taxes, so you may as well skip it if you wish.

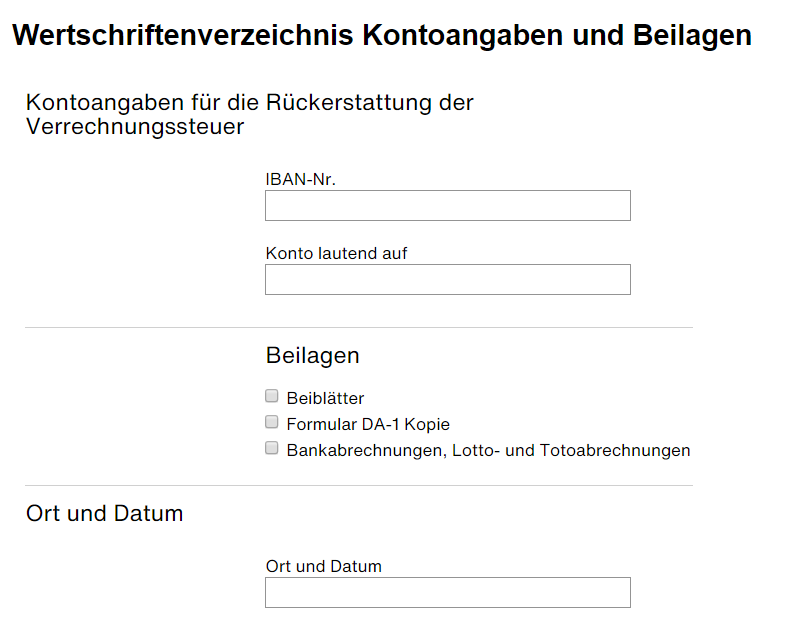

Account details

Kontoangaben

Write here the bank account details where the tax office should transfer you potential withholding tax refunds. The first two fields are just IBAN and account holder (Konto lautend auf).

The checkboxes read:

- Beiblätter: check if you’ll provide auxiliary docs such as a broker report

- Formular DA-1 Kopie: check if you’re filing a DA-1 form. More info on that later in this entry

- Lotto- und Totoabrechnungen: check if you won the lottery 🙂

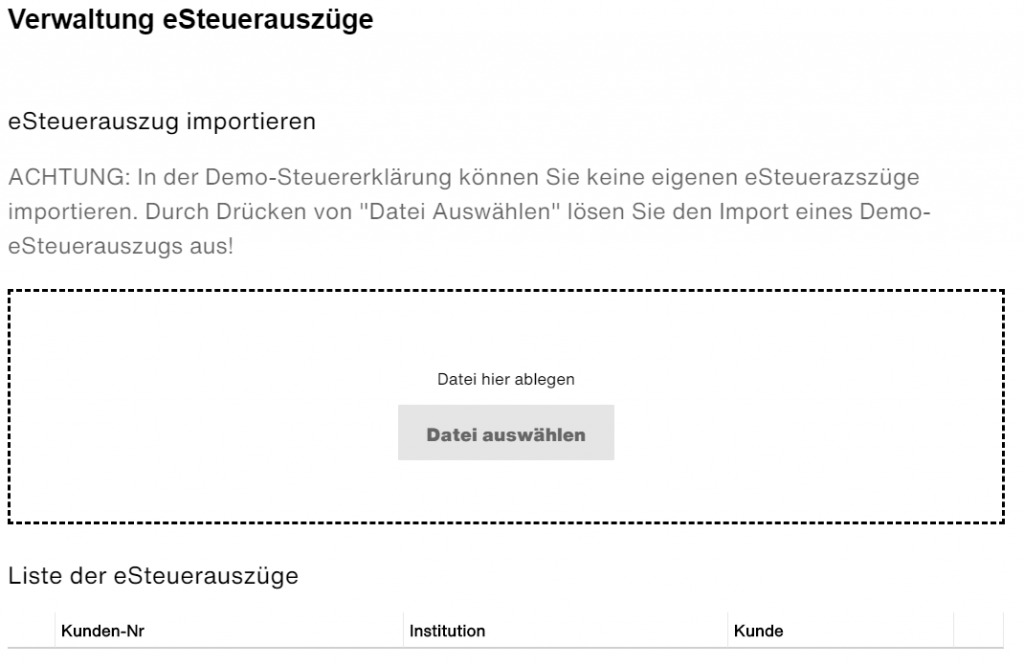

Administration of e-tax statements

Verwaltung eSteuerauszüge

If you have an e-tax statement, upload it here. If you don’t know what this is, skip this form.

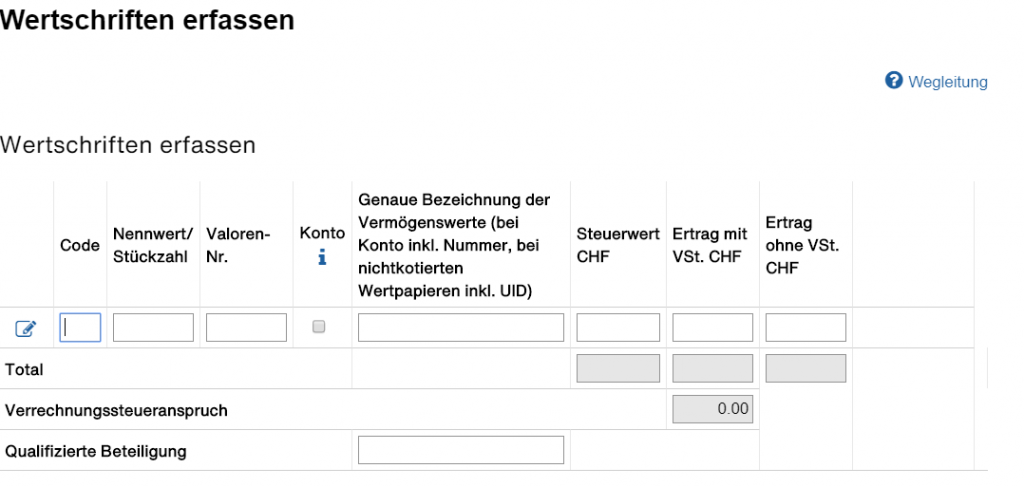

List of securities

Wertschriftenverzeichnis

This is a very important form. You must list all your worldwide securities. Securities are stocks, funds, ETFs, bonds, cryptos etc. You must also list any bank account or fixed-term deposits. By clicking the pencil icon you can see a full list of relevant assets. Use Google translate if you’re not familiar with the German terms:

We won’t cover all 20 options in this guide. Instead, we’ll focus on those that I consider the most common:

- Bank accounts (Konto)

- Investment funds (Anlagefonds)

- Stocks (Aktie)

Other options should be relatively easy for you to crack if you get the basics of those three.

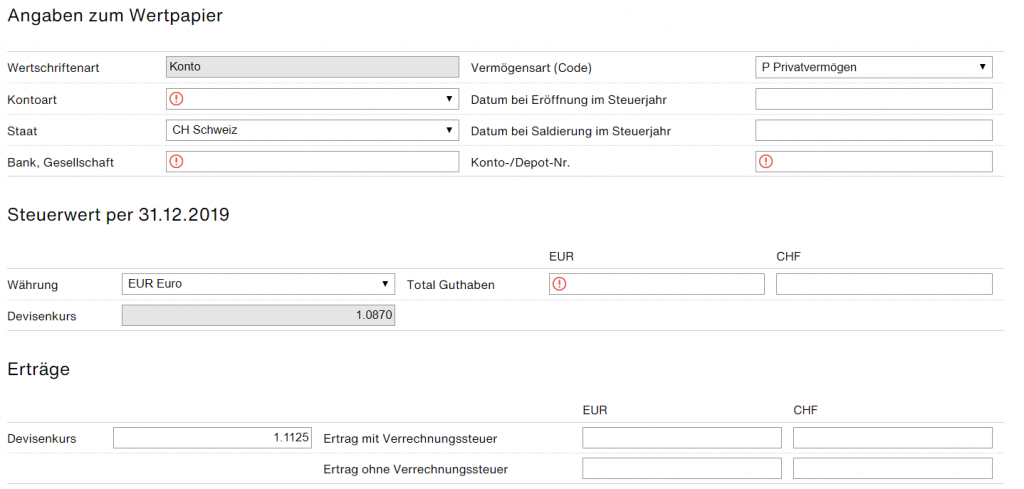

Bank accounts

List all your bank accounts here. Remember that, as a Swiss resident, you’re taxed on your worldwide movable private assets. That means that any foreign bank account belongs to here as well. Even if you “forget” a bank account, the Swiss authorities will easily find out thanks to AEOI. By the way, AEOI also applies to any other securities discussed below (e.g. funds, stocks).

The form is easy enough to go through. The most important fields are the bank (Bank, Gesellschaft), IBAN (Konto-/Depot-Nr.), currency (Währung) and total assets (Total Guthaben). Write any interests to you get under Erträge. If the interest is net of withholding tax, write it under Ertrag mit Verrechnungssteuer. If it’s gross of it, write it under Ertrag ohne Verrechnungssteuer.

Investment funds

Funds are a bit more complex than bank accounts. Guess why? Because the Swiss tax authorities want to tax you on interests or dividends received.

There’s something important to have in mind. Any investment in overseas domiciled funds with reclaimable withholding tax should not be listed here. Instead, you should list it in the DA-1 form. We’ll cover it later in this entry.

Any foreign funds or stock eligible for withholding tax reimbursement must be included only in the DA-1 form. And not in the general list of securities

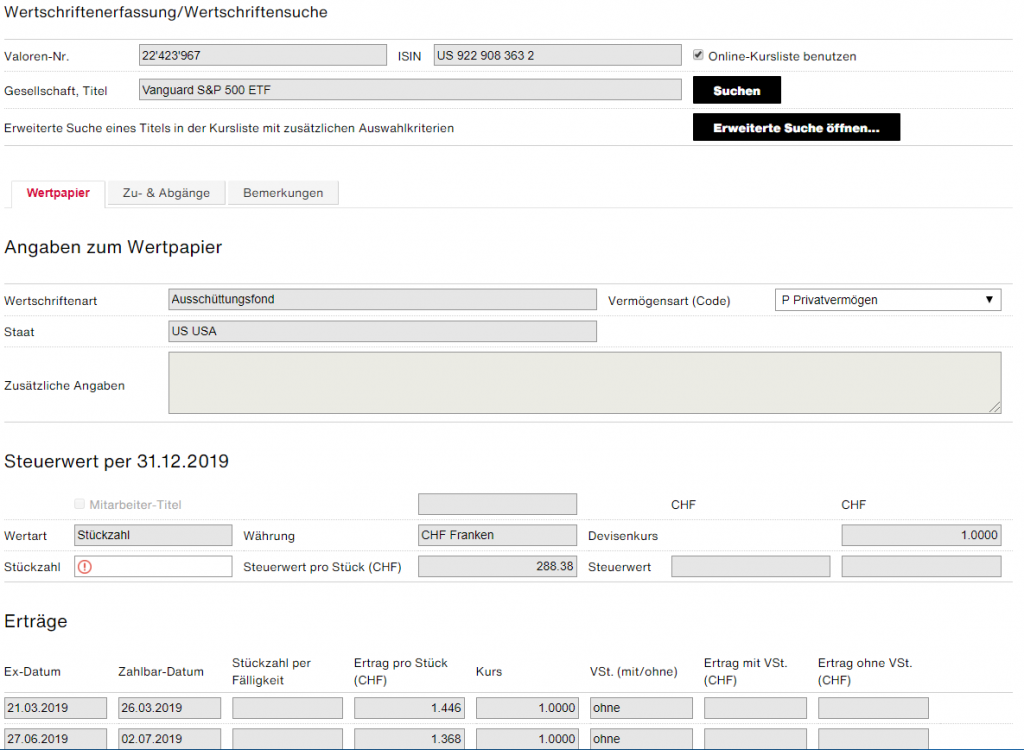

Alright, how to deal with the rest of the funds? By far the easiest option is to search your fund by ISIN on the top section (Wertschriftensuche) and load data from there. In my experience, this works quite well. It liberates you from having to gather data on stock prices at year-end, (ex-) dividend dates, dividend yields, currency conversions etc. In the screenshot below you can see an extract after loading VOO (for illustration purposes only, VOO should rather be in the DA-1 form because it’s a US domiciled ETF).

Is the fund data there? If so, indicate the number of shares (Stückzahl) you held at year-end. Then, switch to the tab Zu- & Abgänge and write the amount of securities at the beginning of the year (Endbestand Vorjahr/Anfangsbestand Steuerjahr). Then add as many log entries for purchase/sale (Kauf/Verkauf) as necessary. This is important because timing matters when it comes to dividend taxes. VOO for example has four dividend payouts per year. You don’t pay the same taxes if you bought 20k worth of VOO in January or in November.

As a final remark, the securities database used by the online tool is the same as this one (ICTax). You can access it at any time. And it’s conveniently available in English.

Stocks

Declaring stocks is quite simple if you understood how to declare funds. The forms are exactly the same. Simply search by ISIN and follow all guidelines above. Remember not to declare foreign stocks here, but later in the DA-1 form.

A note on pillar 3a

It’s not required to add your pillar 3a portfolio as part of your assets. As explained in this entry, pillar 3a portfolios are exempt from:

- Income taxes (e.g. taxes on dividends)

- Wealth tax

Qualified holdings in private assets

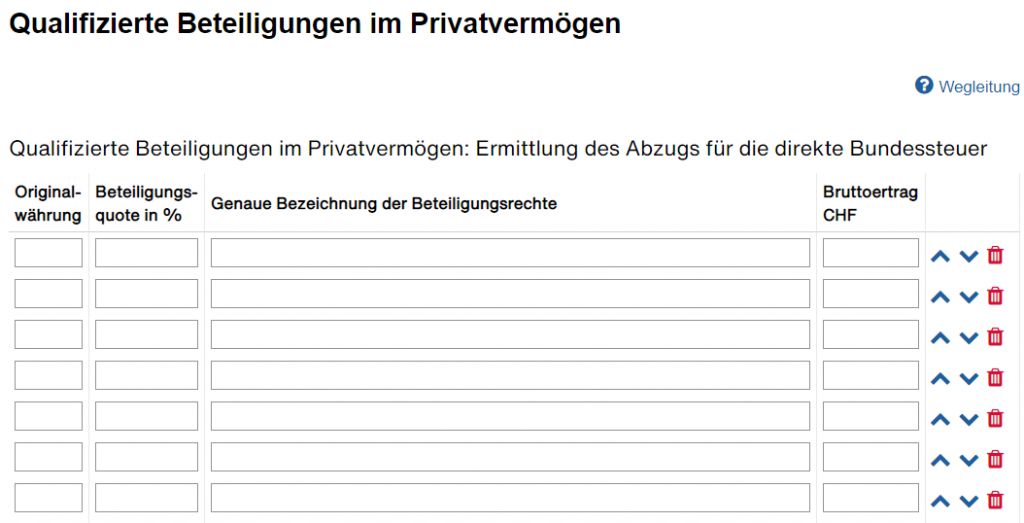

Qualifizierte Beteiligungen

My understanding is that this form is used to list investments/holdings in private companies. This includes limited partnerships, limited companies, cooperatives etc.

Distributed profits from qualified holdings are taxable only if you own at least 10% of the share capital [1]. If you’re in doubt, you should check with your local tax office.

The DA-1 form

The remaining of this entry focuses on the DA-1 form. We’ll see what this is before moving on to the different forms.

What is a DA-1 form?

A DA-1 form is used to recover withholding taxes from overseas investments. Recovering withholding taxes is always desirable.

Can I always recover foreign withholding taxes?

No, you can’t. The tax authorities will only reimburse you foreign withholding tax if you meet all of the following conditions:

- You invest in foreign securities in a country that withholds tax

- There’s a tax treaty between the two countries to prevent double-taxation

- The withholding tax is L2WT (and not L1WT)

- You are claiming more than CHF 100

The third requirement is the trickiest. Let’s see an example with the US. In practical terms, requirement #3 means that you have to invest in US domiciled funds to claim back US withholding taxes. You can’t invest for example in an Irish fund that buys US securities. Learn more about the topic in this entry.

For which countries is the DA-1 form relevant?

The DA-1 form is most commonly used to recover US withholding tax. In theory, though, you could use it with other countries. The necessary condition is that a tax treaty between the foreign country and Switzerland exists. Find here a full list of applicable countries as of tax year 2020.

How much does the DA-1 form give back?

For most countries, the recoverable withholding tax is 15%. This includes the US. This is a nice article on the topic, although a bit old and in German only.

Note: starting tax year 2020, DA-1 gives back slightly less than 15%. This is because:

- Any deduction taken as part of the cost of management of assets (which we saw here) is substracted from the eligibile reimbursable dividends

- The recoverable withholding tax is now ~14.5%

Example: your US dividends are CHF 10k. You deducted 2k from the cost of managing assets. DA-1 form will give you back ~(10k – 2k) * 0.145 = ~1.2k (and not 1.5k).

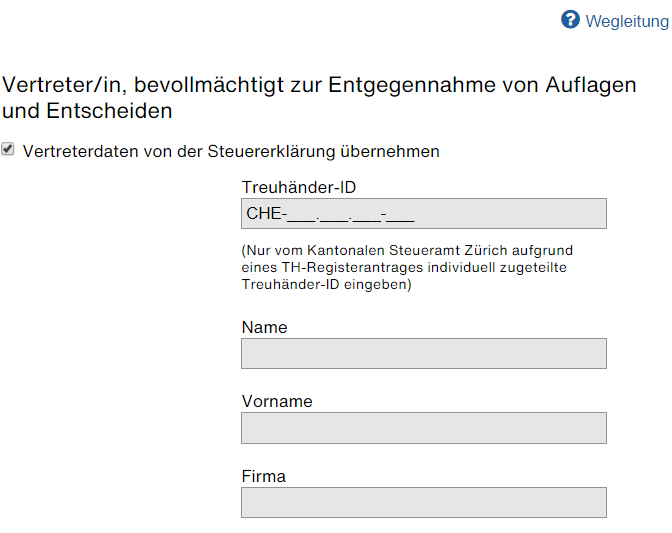

DA-1 representative

DA-1 Vertreter/in

This form is used to allow an accountant or tax advisor fill in your DA-1 form. If this doesn’t apply to you (either no DA-1 or no tax advisor), just skip it.

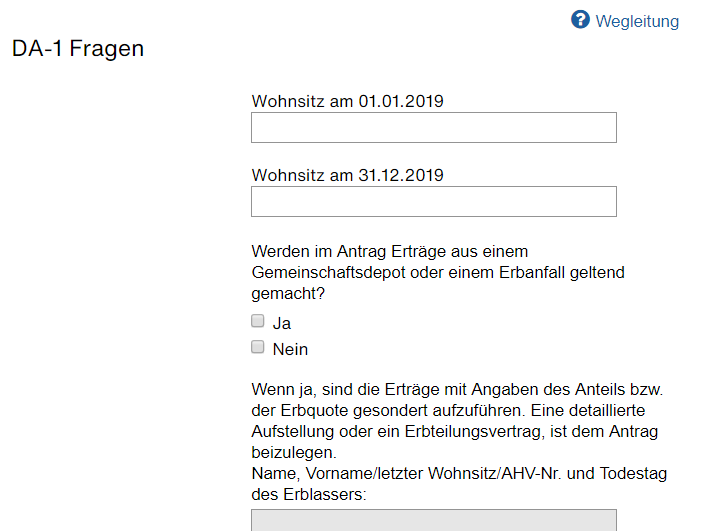

DA-1 personal details

DA-1 persönliche Angaben

This form is easy enough. Just write:

- Your place of residence both at the beginning and the end of the year

- Whether you got income from community holdings (Gemeinschaftsdepot) of inheritances (Erbanfall)

- Whether you’re applying for US citizenship

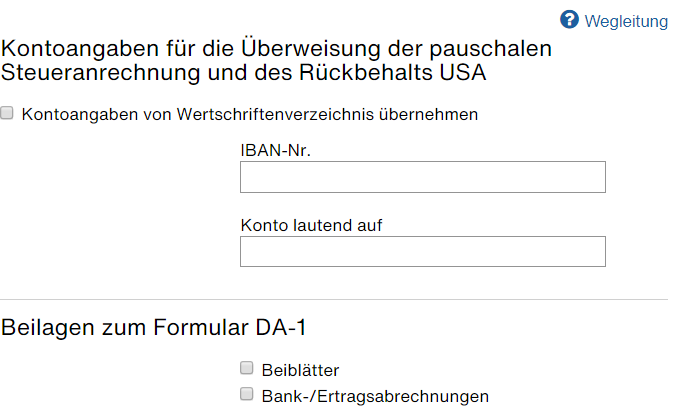

DA-1 account details

DA-1 Kontoangaben

Write in this form the IBAN and account holder where you’d like to have your overseas withholding tax reimbursed. You can simply check the top box to transfer the details you wrote earlier in this theme.

Tick Beiblätter if you’re providing auxiliary docs such as a broker report (you should). Also tick Bank-/Ertragsabrechnungen if you have any relevant bank or income statements to disclose. The latter likely won’t apply to you.

DA-1 securities

DA-1 Wertschriftenverzeichnis

We finally got to the core of the DA-1 form. List here all your foreign securities eligible for L2WT reimbursement. The process is exactly the same as the one explained above for general securities. Remember that securities are listed either here or in the general securities list. Never in both.

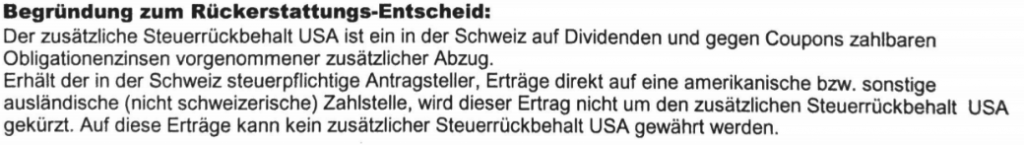

In this form, the column Pauschale Steueranrechnung refers to the actual reimbursement of withholding taxes. For example, the 15% you can reclaim for US investments. Don’t get this mixed up with the column Steuerrückbehalt USA. The latter refers to the additional 15% withholding tax that Swiss brokers retain on US securities. This applies to Swiss brokers and Swiss brokers only. There’s more info on the topic here. The bottom line is to make sure you load 15% in Steuerrückbehalt USA if you use a Swiss broker. You will also have to attach proof to your tax declaration. You should get it from your Swiss broker.

DA-1 proof

You’re required to submit proof of dividends received (and withholding taxes on those dividends) as part of the DA-1 form. The easiest way is to get your broker’s end of year report. Most are geared to tax purposes and include all this info.

Themes in the tax declaration guide

- Persönliches (personal data)

- Einkünfte (income)

- Abzüge (deductions)

- Wertschriften (securities)

- Vermögen (wealth)

- Abschluss (completion)

Last updated on September 11, 2021

25 replies on “Tax declaration guide (4/6): Wertschriften”

Nice, thanks!!

Question: If someone buys shares and sell them in the same fiscal year but with no dividends received, should he declare the transactions (buy and sell) in his tax declaration?

Said otherwise: Do people that make daytrading as a side hobby (example: CHF 2000 of capital gains in a year) usually declare all of their pump and dump in the tax declaration?

Thanks

Haven’t faced that situation myself, but afaik yes, you should report it. I guess it’s something that would get you closer to being considered a professional trader by the tax authorities, so “forgetting” about it could potentially get you in trouble. That said, if it’s really about 2k capital gains taxes I don’t think it’d move the needle at all. Dunno what day traders typically do, would be curious to know if you gather some data points! 🙂

Hello,

in your example you are using VOO which qualifies for the DA-1 reduction, and therefore should only be listed in the DA-1 section.

I think it makes sense to use VUSA as an example in that part.

Hi John, that’s absolutely right. As noted VOO is there for illustration purposes only. It should go to the DA-1 form. I’ve made the side note explaining it even more clear.

Great article! Question – how do you declare cash sitting in broker account? I assume under “konto” as well?

Thanks

Hi Tomas! Indeed, I typically write all my cash under Konto (Swiss bank, Revolut, cash in brokerage accounts etc.). All securities go separate in the DA-1 form (at least in my case, as I only hold US domiciled ETFs)

Hi AverageBoy! Great series of articles you have here! Thank you very much for all your work! Quick question, do I need to list also the bank accounts (local or foreign) that were empty at the end of the year? (I have tried out many bank accounts in the last year which I finally left dormant without any money in them)

Personally I wouldn’t. Wealth tax is based on a snapshot of your wealth at year end.

Hello AverageBoy,

Thanks for the article, it gives a clear overview about the subject!

I just need a small clarification:

If I have foreign stocks but they do not give any dividend, should I include them in the LIST OF SECURITIES or in the DA-1 form?

Thanks

Hey Nagar, happy it was helpful!

Whether you include something in the list of securities or in the DA-1 form doesn’t depend on whether it gives dividends. It depends on where the stock/fund is domiciled. Is the domicile of your stocks one that could benefit from a tax treaty (find out here)? If so -> DA-1. Else -> list of securities.

What is the reason to include a foreign security (e.g. US stock) that had no dividend in the tax year on the DA-1, rather than the list of securities?

Since there was no dividend there was also no tax withheld and so you can’t benefit (this year) from a tax treaty (despite the domicile).

I’m wrapping up my my first tax declaration and would like to know whether I’m doing something wrong not checking the DA-1 checkbox for foreign securities that had no withholding taxes in the tax year.

Thanks in advance!

Hi Jan, I’m with you. If there’s no dividends paid whatsoever it shouldn’t matter where you put it

Hoi – thank you for these articles. Glad to know I am not alone trying to file my taxes :). Ich habe zwei fragen:

1. Does Interest Income from a US Bank Account go on Wertschriften or DA-1?

2. I have Dividend Income from my US accounts, for which I pay US taxes when filing my US tax return, but the taxes are not withheld at source during dividend payout. Does this Dividend Income belong on Wertschriften or DA-1?

I assume you’re American/have a green card? I’m kind of at the edge of my knowledge here (have never dealt with the IRS myself), so take this with a grain of salt. For both 1 and 2, I think you’re not entitled to any tax payback through DA-1. Instead, you can get US tax credits against the taxes paid in Switzerland by filling in form 1116.

That said, you should definitely ask the tax office of your canton. They typically even reply in English to English emails. If the above is wrong, it’d be kind if you could come back and share what they told you – other visitors would surely benefit!

Great material and very helpful. I have a question on income from cash sitting in a foreign bank account and withholding tax. Does this go in DA-1 to claim the tax?

Explanatory sites like this are mostly lopsided and full of holes. But yours refreshingly explains those parts the other sites cannot reach. Thank you!

In ZH 2020 the DA-1 threshold has changed from CHF50 to CHF100?

Thank you Robin! 🙂 And you’re absolutely right regarding the threshold change from CHF 50 to CHF 100 – updated!

Hi, thanks a lot for all these great explanations, I finally understood how the DA-1 worked!

Now, with the recent rule changes, I have a question about the cost of management of assets. You say: “Any deduction taken as part of the cost of management of assets is substracted from the eligibile reimbursable dividends”.

Now, my return for the management costs is those costs multiplied with my tax rate, right? So, for example, if I claim 2000 CHF of management costs with a marginal tax rate of 20% I’ll pay 400 CHF less tax.

Now, these 400 CHF are subtracted 100% from the tax at source that I would get back – meaning if my tax at source is smaller or equal to 400 CHF I get nothing back, right?

It seems that there is a sweet spot (in this example, 20%) where declaring management costs would hurt you because of the DA-1 reimbursements, i.e., when my taxes at source are smaller than my marginal tax rate times the cost of management, and I’d rather not declare the latter… or am I misunderstanding that?

Thanks a lot!

Hi Jan! “Any deduction taken as part of the cost of management of assets […]” refers to the 0.3% flat rate tax deduction one can apply in the value of their investments. It’s all in the link of that very sentence (i.e., here).

Should I declare a bank account abroad if this was opened after the close of the fiscal year I am submitting the tax declaration for?

No, you declare taxes using as basis:

– The income you got over the fiscal year

– The assets you had at year end (20xx-12-31)

Hello. Where should I fill in RSUs (restricted stocks) that vested in the tax year? Payroll already deducted withholding tax.

Hi, in some Kantons, there is the eTax application for online filling.

This application has not DA-1 form; when declaring a security, there is a check to include the stock in the DA-1/USA (I guess, my german is not so good). What I don’t understand is if it is necessary to fill a DA-1 form apart, or the eTax itself fills for you.

On the other hand, my Kanton has said to me that I can declare only my full steuerwert at 31.12.21 and the dividens received, attaching also a Steuerauszug. Is it possible to make this, simply attaching the yearly statement from Interactive Brokers? And also, do I need to fill a DA-1 apart??

“This application has not DA-1 form” – at least Kanton Zurich surely offers the DA-1 with their online tax declaration system.

“And also, do I need to fill a DA-1 apart??” The DA-1 form is not something one has to do, but something one wants to do to recover withholding tax from US domiciled investments. You only want to do it if you have such investments. And, if you do it, it serves as a replacement for assets that would otherwise be declared in “Wertschriftenverzeichnis”.

2 Questions:

1. Say you’ve loaned out a few thousand Euro to a relative during the year, is there a place it’d be beneficial to mention this? I’m just thinking about when that money gets paid back into my account (with zero interest) in the following year, it’d show up as a capital gain over last year even though the money was mine to begin with?

2. I have a Credit Suisse CSX account.. I have no idea what category this falls under and the statements from the online banking app are confusing, does anyone have any suggestions for any idea how to add this to the list?

Thanks for all the help so far.