This entry of the tax declaration guide covers property and capital (Vermögen). This is the fifth theme of the tax filing process. I encourage you (again) to check this out if you want to know more about wealth taxes in Switzerland.

Real estate

Liegenschaften

You must declare the value of all your properties, including those in other cantons or out of Switzerland. This is the first the official guidelines emphasize.

The asset tax value

The official guidelines dictate that the asset tax value (Vermögenssteuerwert) of a house or flat (Einfamilienhäusern und Stockwerkeigentum) used as residential property must be determined in accordance with the tax authorities’ valuation framework.

Long story short, the tax office should send you the asset tax value of your property. If you haven’t received it, contact them. If their framework results in a tax value that is >100% or <70% of the market value, an individual estimate is required. In these cases the final tax value is typically 70% of the estimated fair value.

For apartment complexes and commercial buildings (Mehrfamilienhäusern und Geschäftshäusern), the asset tax value is equal to the ‘earnings value’ (Ertragswert). This likely doesn’t apply to you. In any event, the ‘earnings value’ is calculated using the gross rental income for the tax year and a capitalization rate of 7.05%. The gross rental income excludes utilities, radio/TV fees, staircase cleaning or waste.

No matter what kind of real estate you own, you should contact your local tax office if you are unsure about the tax value of your property. They often are kind enough to reply in English to English requests

Introducing the Eigenmietwert

If you live in a house you own, you have to pay taxes on an ‘imputed rental value’. In German this is the Eigenmietwert or Wert der Eigennutzung. It’s basically the rent that you could receive from a third party. In other words, you pay taxes on the income that you could get out of your own property. The Eigenmietwert is:

- 3.5% of the tax value for single houses

- 4.25% for flats

Let’s look at an example on how to calculate the Eigenmietwert. Say you live in your own flat in Zurich. The flat has a tax value of CHF 600k. Your Eigenmietwert would be 25.5k per year (600 * 0.0425). That’s CHF ~1.5k per month. Here’s another example.

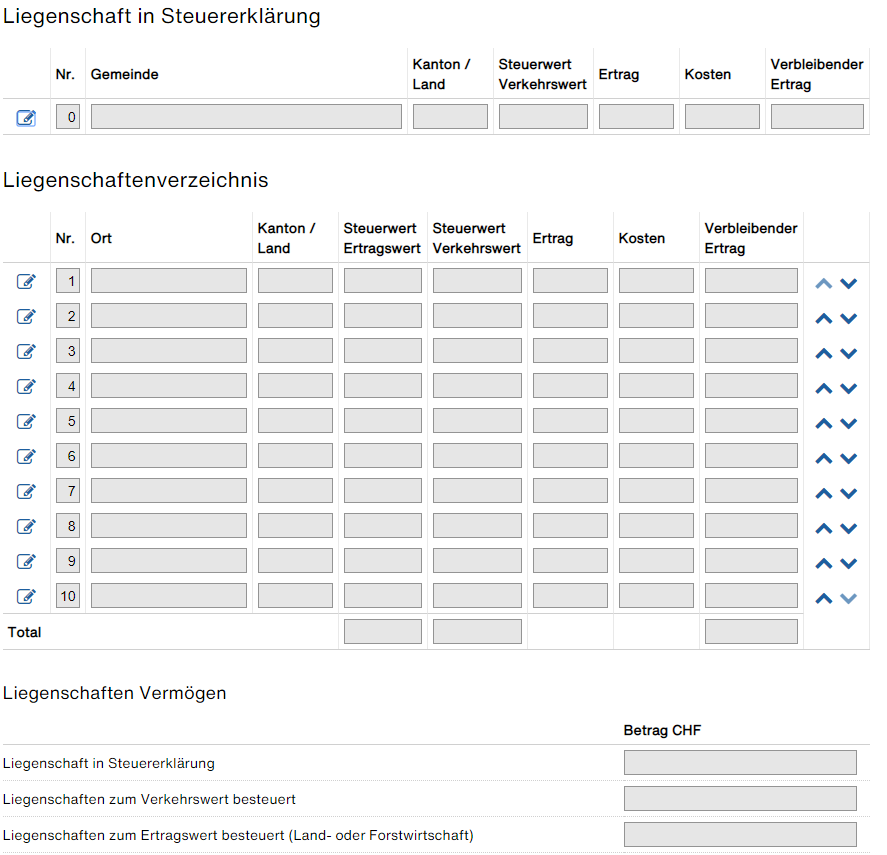

Now that we know the basics around property tax values, let’s look into the specifics of the two forms in this section:

- Liegenschaft in Steuererklärung: top part. This is for your main residence

- Liegenschaftenverzeichnis: bottom part. This is for the rest of your real estate portfolio, if applicable

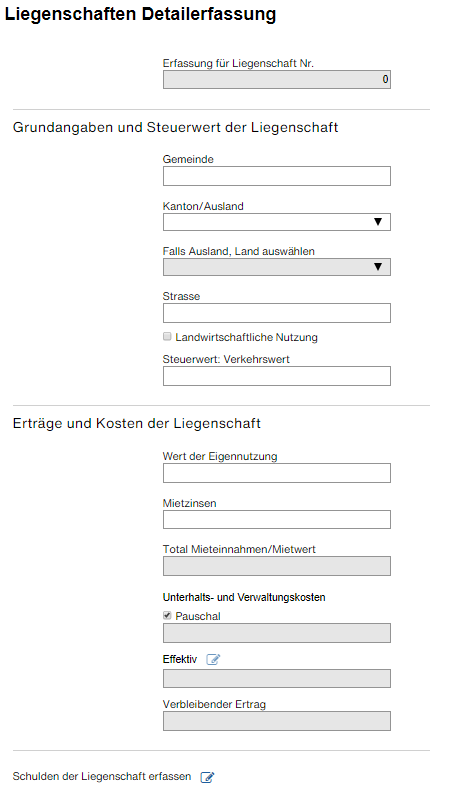

Liegenschaft in Steuererklärung

This form is for your main residence. Fill in the details of the property on the top. Check the box Landwirtschaftliche Nutzung if your property is used for agricultural purposes. Under Steuerwert: Verkehrswert , write the tax value of your property. This is hopefully is validated by your local tax office.

If you live in the property, indicate the imputed rental value (Wert der Eigennutzung). Ideally, this comes from your local tax office as well. If on top of that you receive rental income (e.g. you sublet a room), indicate so under Mietzinsen.

You can deduct property and management expenses from the rental income. If you go for a flat rate (Pauschal), expenses are assumed to be 20% of the income. This isn’t allowed for properties used for business. If you think that 20% underestimates your real expenses, you can fill in a detailed form listing all your expenses. Access it through the Effektiv icon. You must attach proof to the tax return if you go down this road.

Finally, if you have a mortgage, click on Schulden der Liegenschaft erfassen. You’ll get to a form where you can write your outstanding principal and interests paid. This will ensure that your wealth tax corrects for your liabilities (i.e., the mortgage). Plus that the interest payments are deducted from your income.

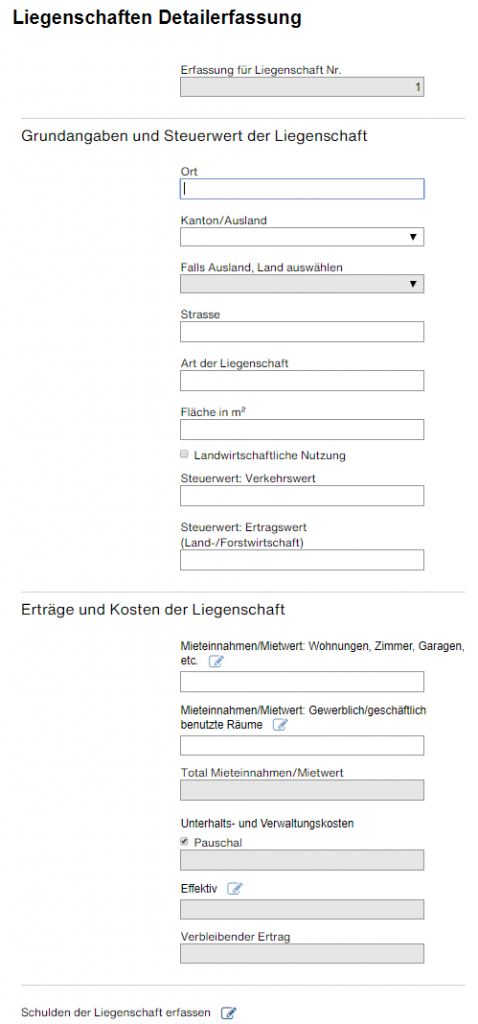

Liegenschaftenverzeichnis

This form is for properties other than your main residence. On the top part, write the surface of the property in m² (Fläche in m²) and the type of property (Art der Liegenschaft). For property type, I’d go with those implicitly mentioned in the official guidelines:

- Einfamilienhäusern: single-family house

- Stockwerkeigentum: condominium

- Mehrfamilienhäusern: apartment block

- Geschäftshäusern : commercial building

Like before, write down the tax value of the property under Steuerwert: Verkehrswert.

In the section below, capture any rental income (Mieteinnahmen/Mietwert). This can be:

- Income from residential purposes (Wohnungen, Zimmer, Garagen, etc)

- Income from commercial purposes (Gewerblich / geschäftlich genutzte Räume)

In any case, you should dedicated forms by clicking the blue pen rather than just writing an aggregated figure.

Finally, you can deduct property and management expenses from the rental income and mortgages just like in the previous case.

Taxes paid due to Eigenmietwert

Let’s continue with our Eigenmietwert example. We already calculated an Eigenmietwert of CHF ~1.5k per month. We’ve learned that we can deduct 20% for property expenses. On top of that, we can possibly deduct any mortgage interest. Let’s say that overall we can bring the taxable figure down to CHF ~1k. At a 30% marginal tax rate, we’d still be paying CHF 300 per month in additional taxes. Not negligible!

Overseas properties

Keep in mind that you have to declare overseas properties. You won’t directly pay taxes on any income received from properties outside of Switzerland. However, this income will influence (i.e. increase) the tax rate for the rest of your income. Besides, you’ll pay wealth tax on the overseas property. You may find this and this helpful.

In general, real estate can be a tricky piece. Hopefully the clarifications in this tax declaration guide will help you. Remember that, when in doubt, the local tax office is your friend. Here are some additional discussions on the topic [1, 2, 3, 4].

Movable property

Bewegliches Vermögen

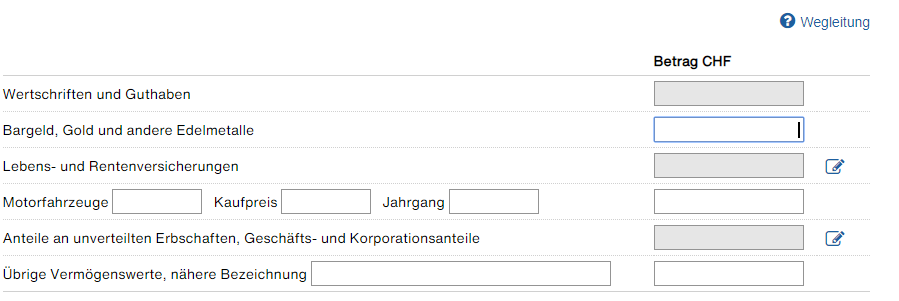

There’s only three fields that concern us in this form:

- Cash, gold and other precious metals (Bargeld, Gold und andere Edelmetalle)

- Motor vehicles (Motorfahrzeuge)

- Other assets (Übrige Vermögenswerte)

The rest of the fields are duplicated in different forms. We’ll cover those later.

Cash, gold and other precious metals

Any local or foreign cash belong in here. Precious metals do as well. Precious metals should be valued at the spot rate as of the end of the tax year. If you don’t have precious metals or significant cash holdings, just leave this form blank. Don’t bother to count the CHF 68.35 in your wallet.

Motor vehicles

If you own a car, you should declare it here. Note: leased vehicles do not have to be declared. Write the make and model, the purchase price and the year of purchase. According to the official guidelines, you can depreciate your car by 40% per year. In German: In der Regel beträgt die Wertverminderung pro Jahr 40% des Restwerte.

Let’s look at an example. Say I bought a car for CHF 50k. In year 1, I should declare a residual value of 30k (50k * 0.6). In year 2, the residual value further decreases to 18k (50k * 0.6 * 0.6). More info available here [1, 2].

Other assets

The official guidelines mention as examples:

- Paintings (I assume expensive ones)

- Jewelry (same)

- Boats and airplanes

Households items are tax-free.

Life and pension insurance

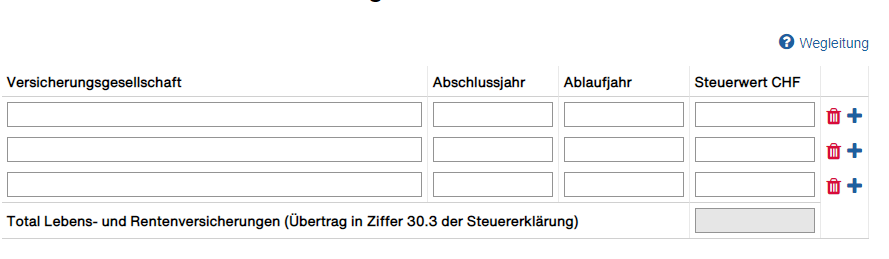

Lebens- und Rentenversicherungen

You pay wealth taxes on redeemable life and pension insurance policies. To clarify: pillar 3a, for example, is excluded. Why? Because it isn’t redeemable in normal circumstances. You should get the tax value (Steuerwert) from the respective insurance company. Make sure you upload a copy of any tax report to your filing.

Themes in the tax declaration guide

- Persönliches (personal data)

- Einkünfte (income)

- Abzüge (deductions)

- Wertschriften (securities)

- Vermögen (wealth)

- Abschluss (completion)

Last updated on March 24, 2021

3 replies on “Tax declaration guide (5/6): Vermögen”

If you own multiple cars, with switchable plates it seems you only pay taxes on the most expensive vehicle. – But that applies to the Verkehrsabgabe, not the wealth tax!

Hi Jan, yes, I agree. I have updated the post to remove the sentence, since I agree it was confusing to have it in the wealth tax section. Thank you very much for the feedback!

Hi, Thanks a lot for this super useful guide, not sure how I would have survived the tax return exercise without it!

One point I could not figure out: I have a private pension account in the UK (Royal London account) from my previous employment, do I need to declare it? (I am not retired)

If yes, where / how should i declare it?

Many thanks!