Optimizing taxes for your ETF portfolio makes a difference. If you have a long investment horizon and invest heavily in ETFs, this entry is a must-read. The higher the share of your net worth ETFs represent, the more important tax optimization becomes. In fact, optimizing your ETF portfolio could be your biggest tax lever to build wealth. Much bigger than any pillar 3a or mortgage interest deduction.

About this entry…

This entry won’t deal with how to declare your ETF taxes. If that’s what you want, you should check this out. Instead, we’ll focus on tax optimization for your ETF portfolio. This means making your ETF investments tax-efficient. The goal is for you to pay less taxes on your ETF investments next time you have to.

This entry assumes that you’re familiar with the basics of ETF investing. If that’s not the case, you should start here.

Scope-wise, most of the content of this entry applies not only to Swiss residents, but also to all non-US investors (e.g. EU residents). Let’s get to it.

Types of taxes on ETF investments

Broadly speaking, you pay two types of taxes on your ETF portfolio. Capital gains taxes and income taxes. Capital gains taxes are relatively easy to deal with as a Swiss resident. Income taxes are a bit trickier. The rest of this entry digs into both.

Capital gains taxes

What are capital gains taxes?

Capital gains taxes are taxes levied on positive differences between the sale and the purchase of an asset. Imagine you bought a stock for $50. After a month, you sold it for $60. You have to pay capital gains taxes on the $10 profit.

Most developed countries charge their citizens capital gains taxes. Switzerland doesn’t. At least not if you adhere to five simple rules.

The five golden rules of capital gains taxes

There are five conditions for your investments not to be subject to capital gains taxes. These conditions are::

- You hold the securities held for at least 6 months

- The total transaction volume (inc. purchases and sales) is lower than 5 times the value of your portfolio at the beginning of the tax period

- Realized capital gains are less than 50% of your net income

- You finance your investments yourself (no margin)

- You only use derivatives (especially options) as a hedging tool, if at all

Tax optimization for your ETF portfolio with respect to capital gains taxes is as simple as sticking to these five rules.

In case you want to check the original, these conditions are listed on page 3 of the doc below. You can also find more info on the topic here.

What happens if you don’t meet any of the conditions?

You should make sure you meet all conditions. You won’t be happy if your capital gains ever get taxed. They’ll be considered income from self-employment activities, and taxed at your marginal income tax rate. If you’ve read this entry, you’ll know that your marginal income tax rate can easily reach 30%+.

How can I make sure I meet all conditions?

In general, if you are a buy-and-hold long term ETF investor, you’re very likely to meet all conditions above and stay clear of capital gains taxes. Check this entry if you’d like to find more about the basics of a long term passive investment strategy.

Conversely, if you engage in daily trading, quick portfolio turnovers or options trading then you’re playing with fire. It’s likely the tax authorities will classify you as a professional trader.

What if I buy non-Swiss ETFs?

It doesn’t matter. The five rules apply:

- To Swiss securities and to non-Swiss securities

- Regardless of the domicile the fund (e.g. Swiss, Irish, US etc.)

- Both to Swiss and to non-Swiss brokers. It’s a bad idea to invest through a Swiss broker, but for different reasons.

To keep in mind if you ever leave Switzerland

If you’re ever leaving Switzerland, make sure you sell your whole ETF portfolio before you move out. You can buy once again when you’re established as a tax resident in the new country. Why should you do this? Because this way you optimize capital gains taxes. Not all countries are as tax-lenient as Switzerland. By selling as a Swiss resident, potential capital gains taxes in the new jurisdiction start counting from 0. This is perfectly legal, by the way. The only caveat is that you’ll probably stay out of the market for a while.

Income taxes

Income from financial products – such as dividends, coupons, interest etc. – is taxable income. And treated as such. We covered the basics of income taxes here.

In here we’ll focus on taxes on dividends. The process is the same for taxes on coupons, in case you invest in foreign bond ETFs.

Can I avoid paying taxes on dividends with an accumulating ETF?

No. Let’s get it out of the way. You can’t avoid paying taxes on dividends by holding accumulating ETFs. We discussed the topic here.

Taxation levels for dividends

Three different geographical levels come into play in the taxation of your dividends:

- The home country of the securities (e.g. Apple’s home country is the US)

- The country where the fund is domiciled (e.g. an ETF holding Apple might be domiciled in the US, but also in Ireland or frankly any other country)

- Your country of residence (e.g. Switzerland)

Each of the countries involved can potentially tax your dividends. Taxes are normally levied in form of withholding tax. Withholding tax is tax automatically deducted by an intermediary when you’re receiving a payment. In general this is bad, because the money is taken from you upfront. Now it’s up to you to fight to get it back. And sometimes you simply can’t.

As explained in the Bogleheads wiki [1], the percentage tax withheld by the home country of the securities is generally referred to as Level 1 Withholding Tax , or L1WT for short. The percentage of tax withheld by the country where the fund is domiciled is called L2WT. The percentage tax imposed by your own country is L3T. We drop the W in this last case because it’s normally not a withholding tax.

We’ll stick to US securities for now

Even if we fix the country of residence to Switzerland (and hence L3T), the amount of possible permutations is huge. To limit the scope, we’ll stick for now to the case of the home country of the securities being the US. In plain words, everything that follows assumes that we’re investing in US securities. Motivation for this is that the US accounts for 55% of the total world equity market [2, 3]. If you’re investing in ETFs, chances are your biggest exposure is the US. I’d argue you’re not investing passively if it’s not.

At the end of the entry we’ll go through some material on-US equities.

The income tax burden depends on fund domicile

So the question is: if we assume that we’re buying US securities (home country of securities fixed) and that we live in Switzerland (country of residence fixed), which fund domicile minimizes our tax burden? Most popular choices are US and Irish domiciled ETFs. The table below summarizes all three taxation levels in both cases:

| Fund type | L1WT | L2WT | L3T¹ | Total² |

|---|---|---|---|---|

| US domiciled fund, without tax treaty | 0% | 30% | 30% | ~50% |

| US domiciled fund, with tax treaty | 0% | 0%³ | 30% | ~30% |

| Irish domiciled fund | 15% | 0% | 30% | ~40% |

¹ This is your marginal income tax rate in Switzerland, 30% used as illustration

² Simplified as 1 – (1 – L1WT) * (1 – L2WT) * (1 – L3T), a more complex and accurate formula that considers fund yield and TER can be found in the Bogleheads article [4]

³ 15% through tax treaty in case of Switzerland, but can be further reduced to effective 0% through DA-1 form

Let’s analyze one by one the rows of this table:

- US domiciled fund, without tax treaty (generic case, not in Switzerland): The US government does not withhold any tax when US securities distribute income to US funds (i.e., L1WT is 0%). However, by default, foreign individuals or entities receiving income from the US are subject to a 30% US withholding tax (L2WT). On top of that, your have to declare the dividends and pay income tax on the dividends to the Swiss tax authorities (L3T). In the absence of a tax treaty, we’re double-taxed by the US and Switzerland. In total, we’re looking at an effective ~50% tax rate on dividends

- US domiciled fund, with tax treaty: This is when things get interesting. L1WT is still 0%, but as a Swiss resident you can benefit from the US-Switzerland tax treaty. This treaty prevents double taxation on income. It allows to reduce L2WT from 30% to 15%. And even that remaining 15% can be recovered, making L2WT effectively 0%. As a result, all you pay is L3T to the Swiss tax authorities. There is no double taxation. Although we’re focusing on Switzerland, similar tax treaties exist between the US and most EU countries

- Irish domiciled fund: Funds in Ireland benefit from a US-Ireland treaty. Instead of paying the regular 30% withholding tax when receiving income from the US, they pay just 15%. This means that, if we invest through an Irish fund, our L1WT is just 15%. Irish funds do not keep any additional tax on top of that when they distribute the dividends to us. In other words, L2WT is 0%. Compared to the first case, instead of paying 30% as L2WT when the US distributes funds to us, we’re using an Irish fund to lower the burden to 15% as L1WT. Once again, however, you have to add L3T. All in all, we’re being double-taxed (albeit less than in the first case) and paying ~40% in taxes

When investing in US equities as a Swiss resident, US domiciled funds are the most tax efficient alternative

Tax optimization for your ETF portfolio – practical steps

So much with the theory. Considering everything above, which steps should you take to invest in US securities in the most tax efficient way? For capital gains taxes, you have to play within the five boundaries we introduced above. For income taxes, you have to follow three steps.

Step 1: Go for a US domiciled fund

Ditch your Irish ETFs and replace them with US domiciled funds instead. Which funds? A portfolio of Vanguard ETFs is a popular choice. Find out more in this post. Not only are these funds the most tax efficient to hold as a Swiss resident. They are huge and have crazy small TERs and bid-ask spreads compared to their Irish counterparts.

However, beware that, if you invest through a US fund, you will trade and hold wealth in USD. This post discusses the currency risk of such investments.

Step 2: Reduce US withholding tax to 15% by benefiting from the US-Switzerland tax treaty

We saw that, in general, foreign individuals receiving income from the US pay a 30% withholding tax (L2WT) to the US government. This applies to dividends, interests, coupons, rents, annuities, etc. This means that right from the get-go you only see 70 cents for every dollar in dividends received.

Luckily for us, it’s easy to benefit from the US-Swiss tax treaty and reduce this withholding tax to 15%. The necessary conditions are:

- Your broker is a Qualified Intermediary (QI): for you to benefit from any tax treaties with the US, your broker must have gone through the IRS (US tax authorities) and acquired QI status [5]

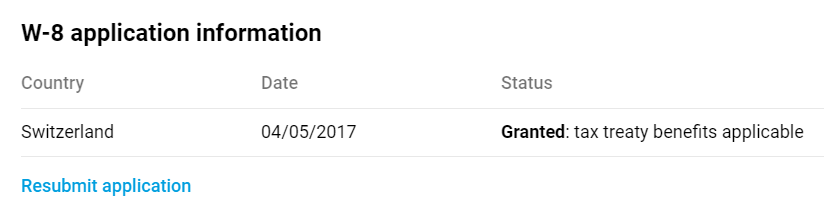

- You have filled a W-8BEN form: This form allows you to claim a reduction in withholding tax by benefiting from the US-Switzerland tax treaty [6]

These two conditions look scary. But they aren’t. Both Interactive Brokers (IB) and Degiro are QI. Moreover, both of them make you file the relevant W-8 forms when you first open your account or buy your first US security. All in all, if you use IB or Degiro, chances are that you are all set. Nothing to be done here.

I’m sure there’s plenty of Swiss brokers that are QI as well. I personally recommend to stay away from them, so I can’t really give examples.

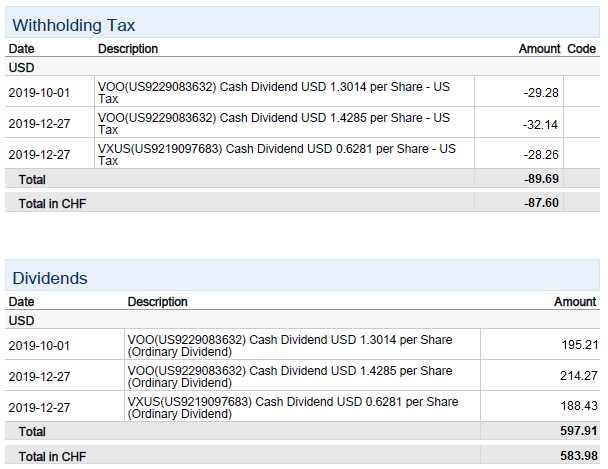

Step 3: Claim the remaining 15% US withholding tax

This is arguably the most burdensome step, as it requires active involvement from your side. You can recover the remaining 15% tax withheld in the US and effectively bring L2WT to 0%. To do so, you have to fill in a DA-1 form with the Swiss tax authorities. You can do this on a yearly basis as part of your tax declaration. The process is described in detail here.

It is important to emphasize that the DA-1 form can only recover L2WT. You cannot use a DA-1 form to recover L1WT. More plainly speaking, you can only claim back taxes paid in direct distributions to you. In the case of Irish funds, the tax loss takes place when the fund receives the dividends from the US. This is not when you receive the dividends yourself. Because of that, you don’t have ‘the right’ to claim it back.

More on the DA-1 form

You’ll have to be claiming at least CHF 100 for the DA-1 form to reimburse you any tax at all. Let’s do some simple math to see what’s the investment threshold. We’ll take the S&P 500 as an example. The S&P 500 dividend yield hovers around 2%. It follows that you need a minimum investment of CHF ~34k to benefit from the DA-1 form (solving for 100 = 2% * 15% * x).

As a curiosity the withheld 15% tax actually stays in the US no matter what. At least as far as I know. It’s actually the Swiss tax authorities who make up the difference to prevent double taxation. I guess that the US reciprocates as part of the US-Switzerland tax treaty. One way or the other, what we care about is that we can bring L2WT to 0% by filing a DA-1 form.

Efficient taxation for non-US securities

Everything discussed up until now focuses on tax efficiency for US securities. What about tax optimization for a ex-US ETF portfolio?

Direct investments aren’t an option

It’s common for most countries to also withhold taxes on cross-border dividend payments. These taxes can be recovered if there are tax treaties in place between the country of the security and your country of residence. However, same as for the US, it only works for direct investments. Investments through intermediaries such as an Irish or US fund won’t cut it. This makes everything complex. Imagine you want to invest in emerging markets. Are you going to make separate direct investments in 20+ countries? It would be tedious, time-consuming, and expensive. Investing through a fund might be less tax-efficient. But it’s still very likely a better choice.

The right fund domicile for non-US securities

So let’s say we won’t consider direct investments. We’ll stick to funds as a way to invest in non-US securities. We want the fund to be as efficient as possible in collecting dividends. We want to minimize L1WT.

L1WT depends on the tax treaties between the home country of the securities (e.g. Indonesia, South Korea, China, etc. for emerging markets) and the country where the fund is domiciled (e.g. Ireland, US).

Getting a list of L1WT by fund domicile for different ETFs is time consuming. It requires to dive into the ETF annual reports. One by one. Luckily, the folks from bogleheads put a couple of tables together with estimates for L1WT.

The data is scarce and doesn’t allow for a perfect apples-to-apples comparison. Still, I’ll synthesize a couple of data points to try to make sense of it:

| ETF | L1WT US fund | L1WT Irish fund | ||

|---|---|---|---|---|

| Emerging markets | 10.8% | 9.4% | ||

| ex-US developed markets | 7.5% | 5.5% | ||

ETFs used: iShares MSCI Emerging Markets ETF (EEM), Vanguard FTSE Emerging Markets UCITS ETF (VFEM), iShares MSCI EAFE ETF (EFA), Vanguard FTSE Developed Europe UCITS ETF (VEUR); L1WT is a 5-year average, if available. All data from bogleheads wiki

The lack of data and the dispersion of the few data points we have makes it difficult to draw conclusions. However, it seems like Irish funds might have an edge over US. Take this with a grain of salt, though. The higher average fees for Irish funds (TER, transaction fees) potentially offset this very small relative difference.

The corollary

All in all, the most tax efficient way to invest in non-US securities seems to be:

- For global funds (e.g. funds tracking MSCI World or FTSE Global All Cap Index) US domiciled funds still make the most sense. This is due to the big weight the US has. Most dividends will be US dividends, so we can benefit once again from the US-Switzerland tax treaty and the DA-1 form

- For ex-US funds (e.g. MSCI Emerging Markets or FTSE Global All Cap ex US Index) the picture is more complex. Irish funds seem to have a small edge, but it might as well be negligible. Likely it doesn’t matter whether that much whether you go with Irish or US funds

Final words

To ensure your foreign ETFs investment are tax efficient, you have to:

- Make sure don’t trigger any of the conditions for capital gain taxes. If you’re a long term investor, it’s unlikely that you will

- Minimize dividend taxation by investing in US domiciled funds

Keep in mind that investing in US domiciled funds forces you to invest in USD. You”ll face currency risks. These are risks that you have to understand and to accept before moving forward. Hopefully this entry will help.

Last updated on September 11, 2021

12 replies on “Tax optimization for your ETF portfolio”

Dear AverageBoy,

You’re doing a remarkable job with your blog, I love it! I was totally confused about the DA-1 form and the taxation of ETFs in general. Reading your article brought a lot of clarity. One question remains, though:

Using a world-stock ETF that is domiciled in Ireland, 15% of the dividends stemming from US companies cannot be reclaimed via the DA-1 form. Can any of the dividend payments of the stocks from other countries be reclaimed via the DA-1 form? So basically the question is whether Ireland-domiciled world stock ETFs should be listed under “general securities” or under “DA-1-form” when filling out the Swiss taxes?

Hi LarLee, glad that you found it useful :). To my knowledge, every Ireland-domiciled fund goes to “general securities”. With a DA-1 form you can only recover L2WT. Remember that L2WT are “withholding taxes by the country where the fund is domiciled on the dividends distributed to the investor by the fund”. Ireland doesn’t charge L2WT, so there’s nothing to recover.

In contrast, you do pay L1WT. L1WT are the “withholding taxes that the countries of the different stocks in your world ETF retain when the dividends are distributed to the Irish fund”. Unfortunately those are not recoverable via a DA-1 form.

In other words, you ‘like’ L2WT (taxes from fund to you) because you can recover them. You ‘don’t like’ L1WT (taxes from country of security to fund) because you can’t recover them.

Investing directly in US domiciled in ETFs shifts a big chunk of a world’s portfolio into L2WT, increasing tax efficiency. More info here https://www.mypersonalfinance.ch/why-invest-in-us-domiciled-etfs/

Good to know! Thanks a lot!

Dear average boy,

thanks a lot for your great work! I find your blog super helpful & love your approach.

Question regarding dividends & ETFs. stocks give often dividends.

With an ETF investment does one get the weighted average dividend of the Exchange? What about option dividends and so on?

Un abrazo 😉

Hey Javi, that’s right! With ETF investments you get the same dividend yield as if you were manually replicating the index 🙂

I really enjoy your blog. Someone linked it on reddit and im now binge reading it.

I have a quedtion:

Youre mentionen that the broker has to be QI for the 15% tax deduction and you say that both Degiro and IB are QI. I use Degiro and i can not buy US domiziled ETF using it. I dont really understand why you mention Degiro though. Am i too stupid to use Degiro properly to buy US ETF ?

Thank you

Ill probably comment a few more of your articles.

Hi Nikita,

The culprit is PRIIPs – a set of EU investment regulations designed to protect consumers (PRIIPs stands for Packaged Retail Investment and Insurance Products). PRIIPs require fund providers (including ETFs) to produce a Key Information Document (KID). European-domiciled UCITS ETFs were ready with their new KIDs when PRIIPs came into force alongside the MiFID II rules at the beginning of 2018. However US-domiciled ETFs did not comply and, as they mostly serve the US market, producing EU-approved information at their own cost is not a priority.

[source: justETF]

Cheers!

Hey mate, nice write up, thanks! I have (if possible?) a question on individual stock investments. So, the question is buying originally listed stock vs ADR.

For example, Unilever

a) listed in its home location, UK, with ticker ULVR

b) listed in the Netherlands with ticker UNA

c) listed in the US, as ADR with ticker UL

Question: What are tax implications for Swiss based investor, for buying each of these listings? Will taxation be different if he buys ULVR in London vs buying stock listed in Amseterdam or New York offered ADR?

How do I declare in DA-1 firm tax witheld in UK vs when I keep the stock via ADR? The thing is that , what I read in tax sources on that for UK listed stocks, sorry for French, I am based in Geneva – “Les dividendes provenant d’une société sise au Royaume-Uni ne sont pas soumis à l’impôt à la source d’après le droit britannique.” – dividends coming from UK based company are not subject to witholding tax as per UK law. So my understanding is that if I buy UK-based company stock, I will NOT be charged with any witholding tax, 100 % of the dividend will flow into my brokerage account, then in tax declaration for the year, for Swiss authorities, I declare it, but do not need to to add that stock to my DA-1 form (and cannot) be reimbursed for any tax (as none was paid).

But what if I buy such UK-based company stock via US ADR? This is the same business, just ADR, listed in US, in dollars, etc. Will the withholding tax of 15 % be applied by US government, then it can be reimbursed by Swiss govertment by me declaring it in DA-1?

Hopefully this was not confusing and maybe you know the answer.. Many thanks in advance.

Great information, thanks! What I don’t get re. L1WT: The US only seems to have 58 tax treaties, Ireland has 76. So investing in a globally diversified US domiciled ETF (eg VT) is beneficial for L2WT, but perhaps not for L1WT, if various VT-countries withold their dividends, and total withholding sum is greater than the 15% L2WT benefit from US stocks vs. Ireland. But maybe I missed a point?

My personal take: any all-cap global fund (e.g. VT) has ~50% US securities, so optimizing L1WT for US securities is as important as optimizing for everything else combined.

I just wanted to thank the author for this fantastic article.

I have one question – what would happen of tax treaties with the US were to change in the coming decades? I assume that transitioning to Irish ETF is an option but would be very costly from a tax perspective. I’m with US ETFs but I often wonder how much of a long term risk I’m taking.

Great stuff here. I “get” the strategy you outline and finally acted on it. Many thanks!

Getting tested right away, as the portfolio loses value these first few days. But what’s the alternative…

One question. The tax optimization works for, say, VT and VTI, and the US equities they hold. But what about VEA, and VWO for example? Or, more generally, how to optimize taxes in Switzerland for ETFs that hold primarily non-US equities?