The third theme in the tax declaration process gives you the option to list tax deductions. Tax deductions (Abzüge) bring down your taxable income, effectively helping you pay less taxes. If you’re not familiar with how tax deductions work, I encourage you to have a look at this post. This tax declaration guide will cover all possible deductions.

Deduct it all!

In general, you should try to deduct as much possible (while obviously playing within the rules). To make sure you don’t miss any tax deductions, you may use the ideas provided on these websites [1, 2, 3] as a checklist.

Deductions and this tax declaration guide

We’ll cover every type of tax deduction available. Remember that some forms might not be relevant to you. Because tax deductions are a relatively lengthy part of the tax declaration process, I’ll split this theme into three entries. You can find the links to the other two entries at the end of the post. This first entry covers:

- Commuting costs

Fahrkosten - Meals and other professional expenses

Verpflegungs- und übrige Berufskosten - Weekly travels & stays abroad

Auswärtiger Wochenaufenthalt

Commuting costs

Fahrkosten

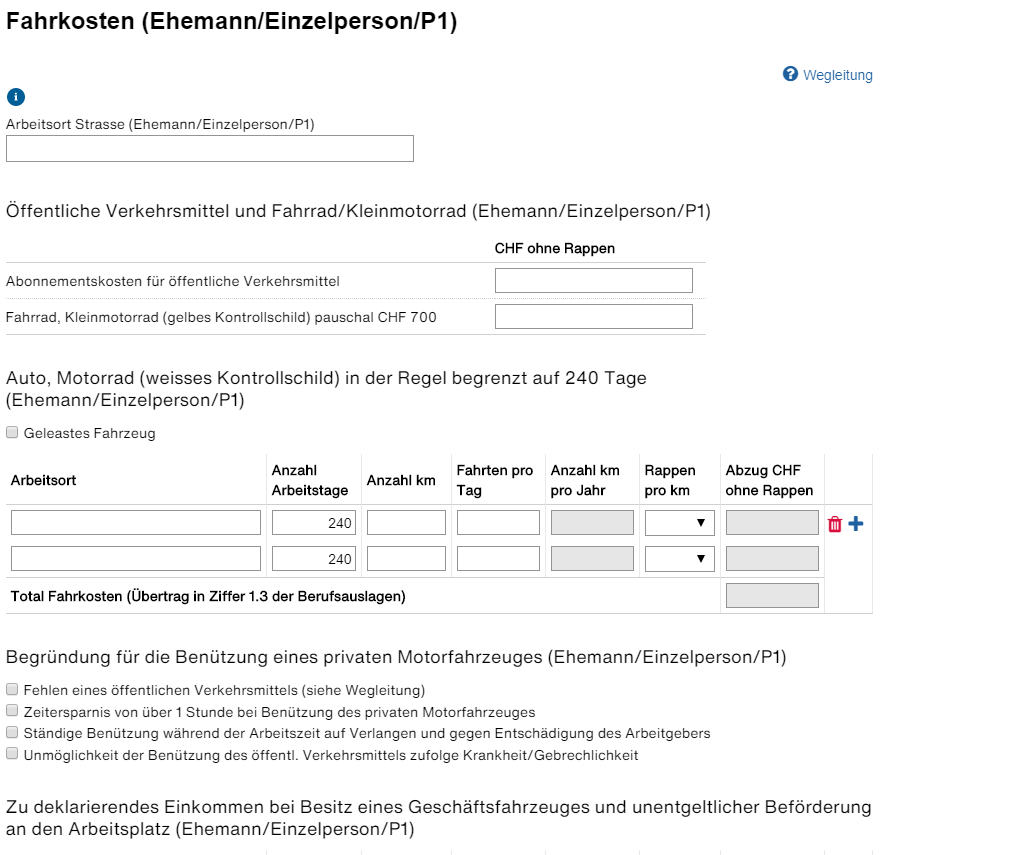

You’ll see this form if you declared income as a full-time employee. It allows to deduct (some) commuting costs. Let’s cover everything you can deduct.

Public transport pass Abonnementskosten für öffentliche Verkehrsmittel

Your abo goes here. For example, if you live in Zurich and have a 2nd class 1-2 zones yearly abo, you should deduct CHF 782 (price as of this link at the time of writing). As far as I know, you can’t deduct everything. The tax authorities know both your address and your company’s address. If you live within 3 tram stops of your office and try to deduct a GA, chances are it won’t go through. The official guidelines say that you can just deduct die notwendigen Abonnementskosten. These are the necessary abo costs to commute. As far as I know, half-fare travel cards can’t be deducted either.

If you believe you have reasons to deduct GA or 1/2, you might as well try. The tax office will correct the info if deemed inaccurate. Here’s some additional discussion on the topic [4, 5].

Bike or other yellow-plates Fahrrad, Kleinmotorrad (gelbes Kontrollschild)

If you own a bike just load CHF 700 in here.

Car/motorbike or other white-plates (Auto, Motorrad (weisses Kontrollschild)

The Swiss tax authorities don’t seem to like this deduction that much. They warn on the official guidelines that car/motorbike deductions can only be claimed if at least one of the following conditions is met:

- There is no public transport alternative

- Public transport is >1km away

- Time savings exceed one hour

- You use your private vehicle for work purposes as requested by your employer

- You can’t use public transport (you must attach proof)

If you’re lucky enough to meet any of the conditions, just fill the form with your commuting data. You should use 40 Rp. for motorbikes and 70 Rp. for cars.

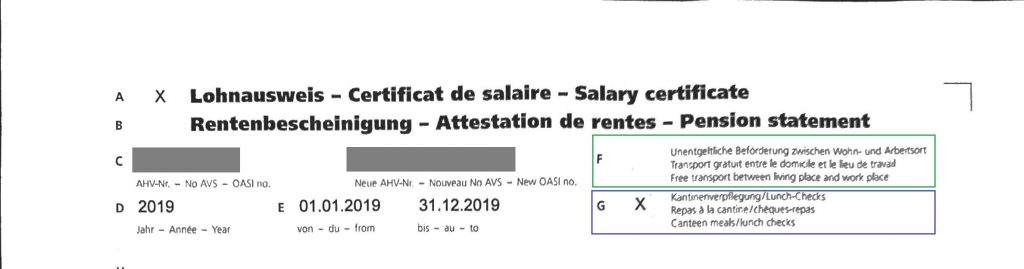

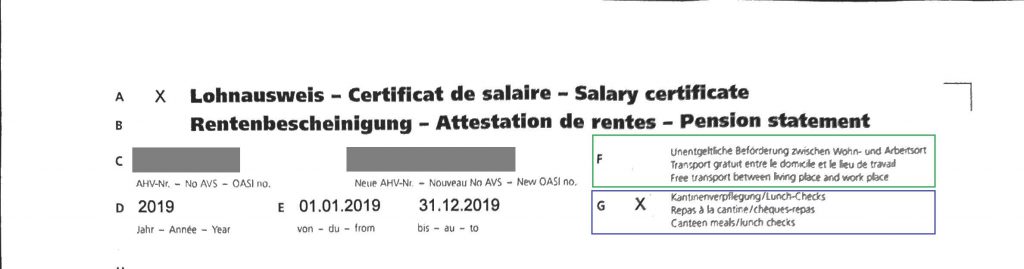

Other remarks on commuting costs

It’s unlikely you’ll get any deduction at all if your Lohnausweis says that you get free transport between living place and work place. This is field F, highlighted in green below.

Remember that the potential tax deduction from commuting costs is capped at CHF 5’000 for cantonal taxes and CHF 3,000 for federal taxes. You shouldn’t spend an hour trying to remember the details of that one-time business trip by car to Lausanne if you’re already over 5k.

Meals and other professional expenses

Verpflegungs- und übrige Berufskosten

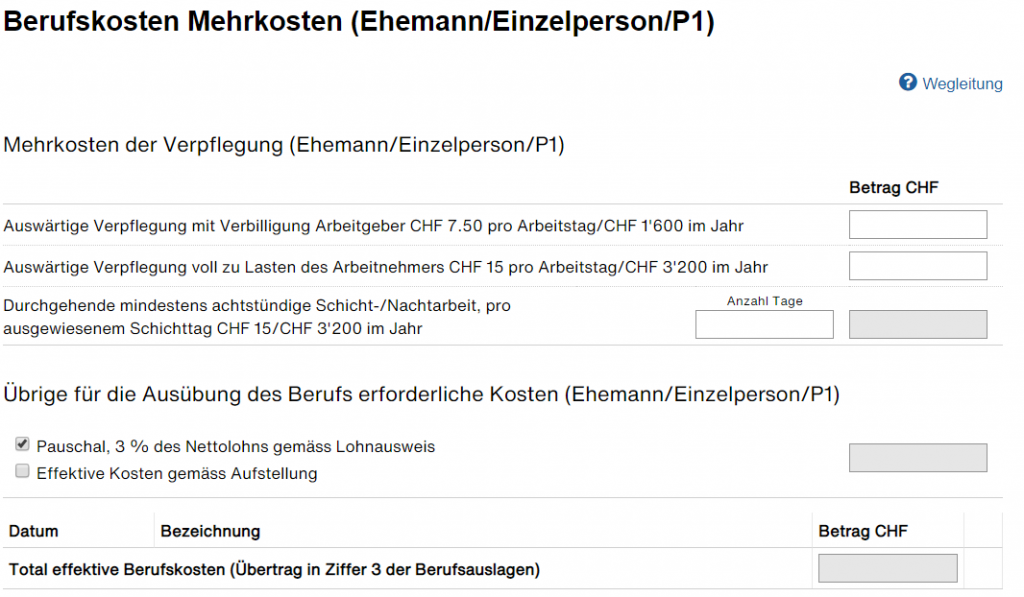

The first section has to do with costs for meals. Only meals in a work-related context qualify. I found this form quite confusing the first time I went through it, so we’ll cover it in detail.

Meals deductions

Auswärtige Verpflegung

There are two possible scenarios for tax deductions:

- External meals with employer contribution

Auswärtige Verpflegung mit Verbilligung Arbeitgeber

Use this if you pay for your meals but your employer somehow contributes (e.g. canteen is subsidized, vouchers etc.). You can deduct CHF 1,600 or prorate at CHF 7.5/day f needed - External meals without employer contribution

Auswärtige Verpflegung voll zu Lasten des Arbeitnehmers

Use this option if you pay for your meals without any aid from your employer. You can deduct CHF 3,200 or prorate at CHF 15/day

In any other case you cannot claim a meal reduction. One way to find out what’s applicable to you is to look once again at your Lohnausweis. If field G is checked, the tax authorities will know that your employer contributes to your meals.

Night shifts

Schicht-/Nachtarbeit

You likely noticed there’s a third box where you can deduct up to juicy CHF 3,200. This one is fundamentally different from the previous two, though. Basically, you can deduct additional CHF 3,200 (or prorate at CHF 15/day) if you work night shifts for at least 8 hours in a row.

Other expenses

Übrige für die Ausübung des Berufs erforderliche Kosten

Moving on to the bottom of the screen, we see other expenses incurred in relation to you job. This includes software, laptops, specialized research or literature, royalties to professional associations etc. These must be things you had to pay for. Your company isn’t you.

There’s two alternatives to fill in this section. The first one is to simply deduct a flat rate of 3% of your net salary. No questions asked. This option is applicable to most of us. The second option is to forego the flat rate and input all your expenses in the form.

You should do the math to see what’s more convenient for you. Even if you had some professional expenses, the flat rate 3% might result in a bigger deduction.

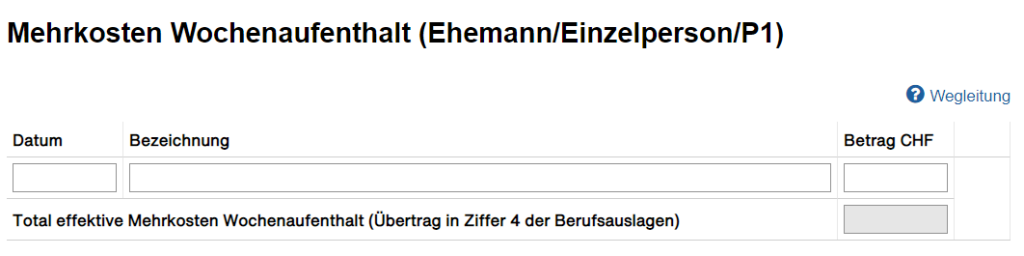

Weekly resident

Auswärtiger Wochenaufenthalt

If you live in a location during workdays other than your place of residence (due to work, studies etc.) you can deduct additional expenses. These deductions include:

- Additional CHF 3,200 (or prorate at CHF 15/day) for dinners during weekly stays abroad

- The rent of a room

- Public transport costs for your trip back home

If you are a Wochenaufenthalter, you have to get a Wochenaufenthalt permit in the location where you work or study. For the city of Zurich, for example, you could find more info here. You can also find more info on the topic here.

Find out about more potential tax deductions in the second part of this entry.

Themes in the tax declaration guide

- Persönliches (personal data)

- Einkünfte (income)

- Abzüge (deductions)

- Wertschriften (securities)

- Vermögen (wealth)

- Abschluss (completion)

Last updated on March 13, 2021

2 replies on “Tax declaration guide (3/6): Abzüge [1/3]”

Just a quick comment on the deductions for Wochenaufenthalt: I think this is clearly regulated and a person needs to be registered as a Wochenaufenthalter, meaning somebody lives at a place only during the week due to work / studies and will return home on the weekend.

It’s not so much for occasional weekly trips for a company. This wouldn’t qualify as a Wochenaufenthalt.

See also this link: https://www.stadt-zuerich.ch%2Fcontent%2Fdam%2Fstzh%2Fprd%2FDeutsch%2FBevoelkerungsamt%2FFormulare%2520und%2520Merkblaetter%2FPMA_Formulare_Merkblaetter%2FWochenaufenthalt.pdf&usg=AOvVaw2ZBgHYegOVJ7bHTJoTJucI

You’re absolutely right, I have adapted the entry. Thank you so much for taking the time to contribute!! 🙂