Welcome to the tax declaration guide! This entry is the intro to a complete, step-by-step, English guide on how to file taxes in Switzerland.

This tax declaration is focused on canton Zurich. Most concepts and steps can be generalized to other cantons.

Official guidelines and disclaimer

The tax declaration guide on mypersonalfinance.ch is by no means an official one. The only official guide is the one that the tax authorities of your canton distribute. For canton Zurich and tax year 2020, this guide is a 44-page PDF. It’s called Wegleitung zur Steuererklärung 2020 (guide to tax declaration 2020). And it’s available in German only. You can access it here, or download it from the link below. The tax office publishes a new version every year. Make sure you always use the most updated one.

The official guide (or whatever your tax office says) holds over everything you might read on this website. I am no accountant or tax advisor and waive all liability on others’ tax filings. You are ultimately responsible for whatever you file in your tax declaration. You should take the guide on this website as an unofficial, secondary source of information.

Manual forms vs online tool

The first step in your tax filing process is an important one. You don’t want to get it wrong. You want to use ZHprivateTax. ZHprivateTax is the official online tool you can use to file your taxes in canton Zurich. It replaces physical forms. You should use this tool to file your taxes and not the physical forms. Here’s why:

- With the online tool the process is paperless end-to-end. Starting tax year 2020, there is no need to send physical copies to the tax authorities by post. Every document can be attached online. Huge time saving

- Once you’ve completed your first tax declaration, subsequent years will be made easy with the online tool. You can import data from previous years and build on it

- The online tool can automatically populate financial data from an official database. This database is maintained by the Swiss tax authorities. Auto-population is extremely useful and saves a lot of time. Just picture the pain of manually fetching info at year-end. Stock prices, exchange rates, ex-dividend dates, dividend yields etc. You don’t want to go through that

- With the online tool, you can easily use live translators while filing your taxes. For example the one built in Google Chrome. This can be a life saver if you’re not a native German speaker

About this tax declaration guide

Most of the sections of this guide were originally written in spring 2020. As such, they’re based on the official guidelines for the year 2019 (latest: 2020). This implies:

- Screenshots might not match the latest design of ZHprivateTax

- There might be new amendments to the official guidelines

After completing my own 2020 tax filing, I can confirm that most changes from 2019 to 2020 are purely visual, and that the guide is good as-is. I still make some minor amendments throughout the guide.

Getting started with ZHprivateTax

Start a new tax declaration

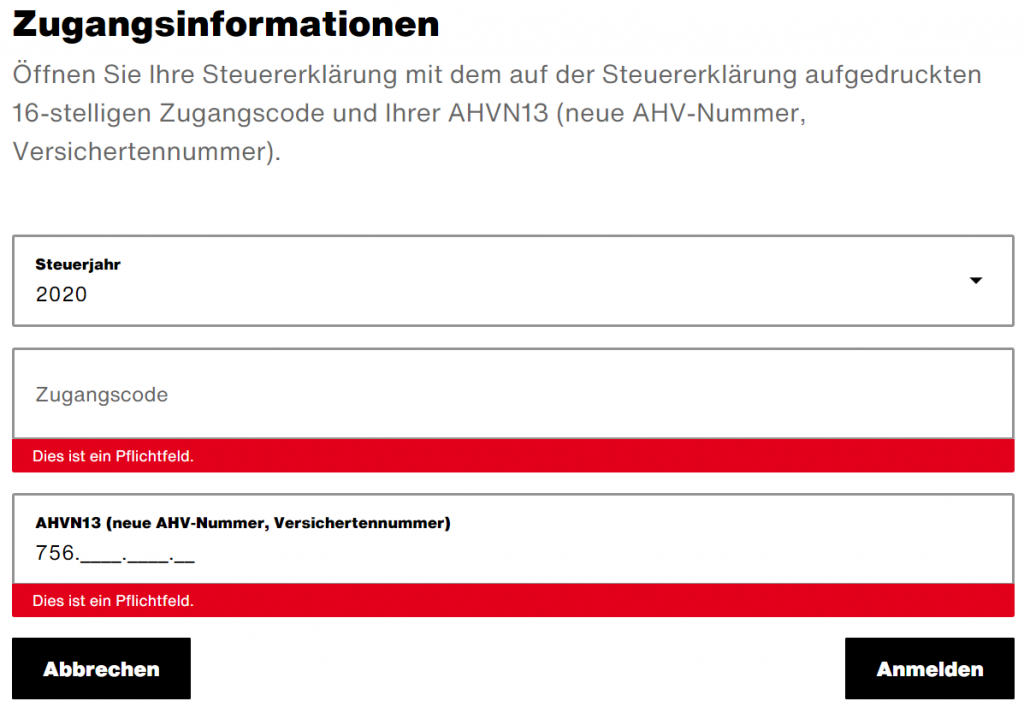

Starting the tax declaration process is easy. The only prerequisite is to have received a one-time access code (Zugangscode) from the tax office. They send it by post. Note that you will only get one if you fulfill the conditions for a regular tax declaration.

Assuming you got your code:

- Go to ZHprivateTax

- Use the easy access option (Vereinfachter Zugang)

- Enter Zugangscode and AHVN number

Landing page

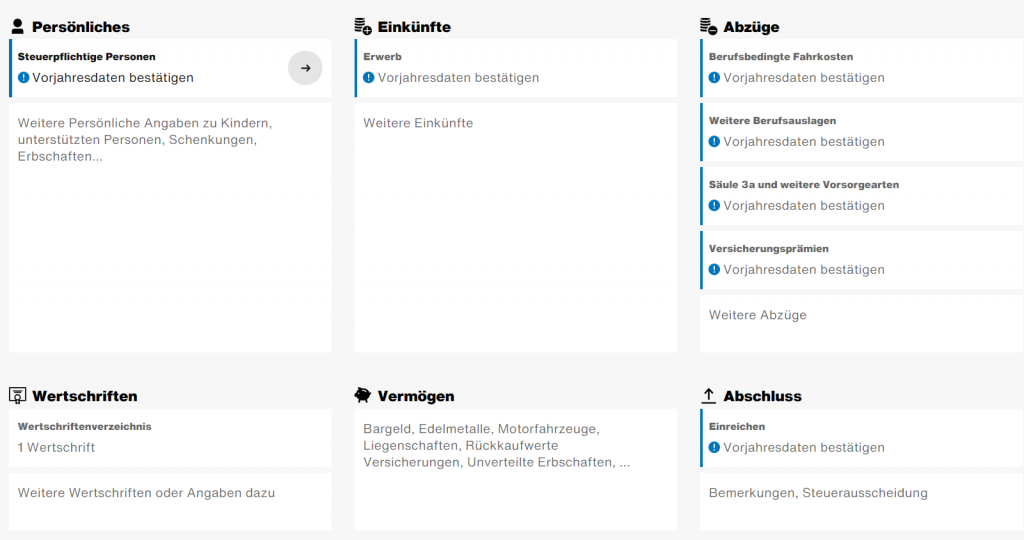

If everything went well, you should land on a page where you can see the six themes of the tax declaration process:

This guide is structured along these six themes. I’d recommended to go through them in order. Not all of them will apply to you. However, I still recommend you skim through all the content. You wouldn’t want to miss out on any juicy tax deduction.

You can always come back

You don’t have to complete your tax filing in one go. Your progress is automatically after every input you provide.

Getting started

The following links will be available at the bottom of each entry of each page. They’ll help you navigate the guide. You should head to Persönliches next.

- Persönliches (personal data)

- Einkünfte (income)

- Abzüge (deductions)

- Wertschriften (securities)

- Vermögen (wealth)

- Abschluss (completion)

Last updated on March 13, 2021

2 replies on “Tax declaration guide (0/6): Intro”

I found your instructions extremely clear and invaluable! Thank you!

One question: I’d need a one-time access code (Zugangscode) to start the process you describe in

https://www.mypersonalfinance.ch/tax-declaration-guide-intro/

I won’t receive this from the tax authorities because my salary is below 120k and I have a resident permit B (however, I need to do the tax return to declare foreign income).

Do you know how to obtain this code?

Thank you!

Stefano

Hey Stefano! I don’t think you’ll get the code if you’re not subject to a full tax declaration due to permit or income. It’s pretty likely the Swiss authorities won’t have visibility over your foreign income until you declare it. I’d suggest to reach out to them (bottom of this page, assuming you’re in canton Zurich).