US domiciled ETFs are very tax efficient for Swiss investors. However, due to certain regulatory issues, it’s not guaranteed that Swiss investors will always be able to purchase US domiciled ETFs. In this article, we discuss why this is the case.

Update: As of February 2022, Swiss residents can still purchase US domiciled ETFs, at least via Interactive Brokers

The PRIIPs regulation

The PRIIPs regulation is behind all uncertainty around the availability of US domiciled ETFs for Europeans. Let’s find out why.

What is the goal of the PRIIPs regulation?

In short, the PRIIPs regulation is an EU regulation that seeks to bring consistency and transparency to retail investment products (PRIIPs).

PRIIPs itself stands for Packaged Retail and Insurance-based Investment Products. In plain English, they’re financial assets typically bought by retail investors (you). ETFs are a prominent example [1].

Which requirements does the PRIIPs regulation introduce?

For investors (you), the PRIIPs regulation introduces no obligations or requirements.

For financial assets providers (such as ETF providers), PRIIPs brings along an obligation to create and maintain a Key Information Document (KID) for each product they offer to retail investors. This document is supposed to help investors assess the costs, risks and potential returns of different financial products. The KID must be made publicly available.

When did the PRIIPs regulation come into effect?

The PRIIPs regulation came into force in December 2014. Its provisions (e.g. KID requirement) only came into effect on January 2018, though [2].

KIDS vs KIIDS

Something that I personally find confusing is the difference between KIIDs and KIDs. In short [1]:

- KIIDS is the old standard. It was covered by UCITS regulations. It stands for Key Investor Information Documents

- KID is the new standard. It replaces KIID as part of the PRIIPs regulation. It stands for Key Information Document

That’s in theory. In practice, the terms seem to be used rather interchangeably by ETF providers. At least based on what I see out there at the time of writing.

What’s the big deal?

If you check the sample docs above, you’ll see that they’re quite similar in terms of content. So what’s the big deal with KIDs and the PRIIPs regulation?

The big deal is that most US domiciled ETFs decided not to comply with the requirement to provide a KID. As a result, European brokers were forced to pull US ETFs from their product offerings. Simply put, EU investors lost access to US domiciled ETFs in 2018.

Why is this a problem?

This is a pain because, as we’ve seen in other posts, US domiciled ETFs are:

- More liquid and efficient to trade

- Cheaper in terms of TER

- More efficient from a tax perspective – although this depends on country of residence. It’s certainly the case for Switzerland, but not necessarily for all EU countries. Spain or Belgium are counter examples

In this other entry, we quantified the impact of such potential tax efficiencies. Spoiler alert: it’s easily in the dozens or even hundreds of thousands if you invest over a long enough time horizon.

Why did US ETF providers decide not to comply?

Because they don’t care. US domiciled ETFs mostly serve the US market itself. And the bulk of European investors that do purchase US funds – and are big enough to matter – are institutional investors, which are PRIIPs exempt [3]. It’s simply not a priority for ETF providers such as Vanguard to spend money maintaining a KID for each of its US products. Only the products they explicitly market in the EU (i.e., non-US domiciled) are being adjusted.

How does this affect investors living in Switzerland?

The PRIIPs regulation is an EU one. Switzerland isn’t EU. How are Swiss residents affected? They’re affected in two ways:

- Brokers might not differentiate between European countries

- Swiss law is following suit

1. Brokers might not differentiate between European countries

We saw that it’s painful (i.e. costly) for US ETF providers to segment their customers into US and non-US (and offer KIDs to the latter). Likewise, it’s painful for brokers to differentiate between investors based in the EU and in Switzerland. As a result, Swiss residents are often bound to the fate of their EU neighbors.

The case is point is DEGIRO’s approach. US domiciled ETFs stopped being available on degiro.ch as of 2019. Why? Because, while meeting the new PRIIPs regulation, they decided it was too much effort to customize their services to Swiss residents. The Swiss market is, after all, quite small. As a result, Swiss investors (in theory PRIIPs-free) were put under the PRIIPs umbrella. Sometimes brokers fit square pegs into round holes.

Here’s an official reply from DEGIRO a user got when inquiring them about the issue:

“Due to the new PRIIPS legislation, as of the 2nd of January 2018 a number of products are now unavailable for European investors, but remained available for Swiss clients. Following the change, all advanced products such as derivatives and ETFs must have publicly available from the provider a Key Investor Information Document (KIID) in any language or a Key Information Document (KID) in the local language of the investor. Products which do not meet the KID/KIID requirements are longer available for European investors.

Unfortunately, we have now taken ETFs off of the platform that do not have a KID/KIID publicly available for all of our clients as we deem the information delivery of these products in necessary.

If you have positions open in these products you will be able to close them however you will not be able to increase your positions.”

2. Swiss law is following suit

A bit of history. There was some turmoil on Swiss investment communities before the start of 2020. At the time, it seemed that the introduction of the Swiss Financial Services Act (FinSA) could jeopardize the availability of US domiciled ETFs in Switzerland. Same as PRIIPs had done in the EU. Time proved those concerns wrong. At least for now. At the time of writing (Sep 2020), Swiss investors can still buy US domiciled ETFs. For example, through Interactive Brokers (IB).

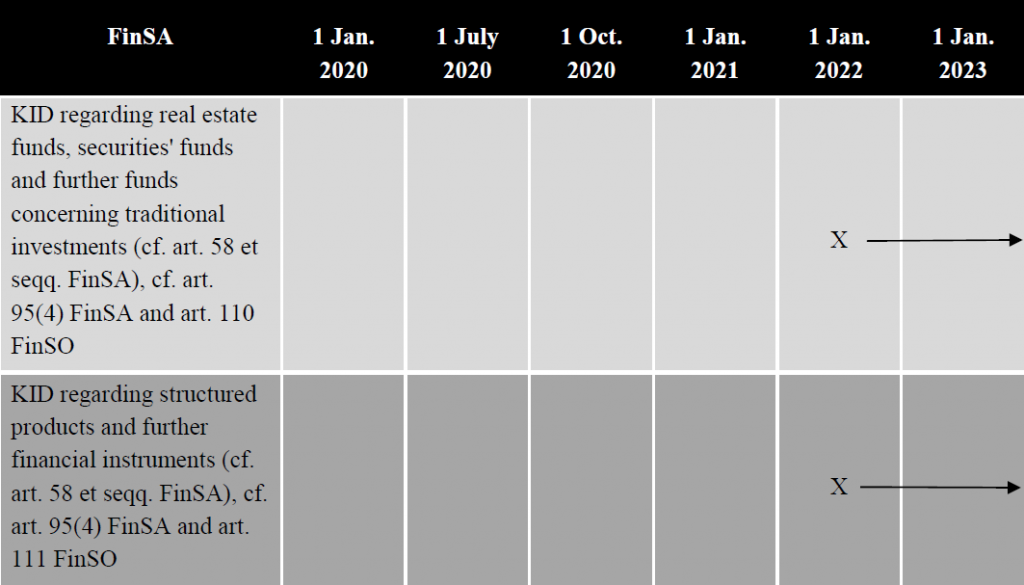

However, many of the provisions of FinSA, including the one that enforces KID requirements, will only come into effect on January 1, 2022 [4]. It’s very likely that nothing will change until then. But what comes next?

There’s no clear consensus on what will happen on Jan 1, 2022.

Update: as of February 2022, it seems like nothing happened

Nobody knows for sure. The requirement for KIDs could force brokers to de-list US ETFs for Swiss investors. But again, FinSA isn’t PRIIPs. The laws are different and the markets they affect are different. At the same time, however, there’s a risk that brokers could cover their asses and simply block US ETFs for investors in Switzerland, even if the law didn’t require it.

What if Swiss investors lose access to US domiciled ETFs?

As discussed in the first section, this would be a step back in terms of investing efficiently. It would force many (e.g. me) include new ETFs in our asset allocation. There are three things we should keep in mind, though.

You could keep your open positions

It seems certain that you wouldn’t be forced to sell your existing positions in US domiciled funds. You simply wouldn’t be allowed to buy more. This is great news. Ultimately, it means that we have to change nothing for now. It still makes sense to invest in US domiciled ETFs. In fact, possibly even more so.

If you already invest in US domiciled ETFs, just keep doing so

You could still buy US ETFs as a professional trader

You can escape PRIIPs (and possibly also FinSA) by “simply” not being a retail investor. For IB, you have to meet at least two out of the next three conditions to qualify as a professional trader [5]:

- Trades in significant size on the relevant market at an average frequency of 10 per quarter over the previous four quarters

- Portfolio size > EUR 500k (cash included)

- Previous professional experience in the financial sector (at least one year)

The last two are clear. The first one isn’t. What’s significant size? Nothing good, according to IB’s site. Significant size implies a total notional value traded of at least EUR 200k.

All in all, meeting two out of three requirements isn’t easy. I don’t think this is an option for an average Joe. But it could certainly save some.

There are other attractive options

Even if we couldn’t buy the Vanguard ETFs we love, Vanguard still has a lot to say. Vanguard’s FTSE All-World UCITS ETF (VWRL) is PRIIPs compliant and a good alternative to VT. The TER is 0.22% (vs VT’s 0.08%), transaction costs are higher and tax-wise it’s worse for investors in Switzerland. Definitely suboptimal. But hey, not the end of the world.

Recap

It’s uncertain whether we (investors based in Switzerland) will be able to buy US domiciled ETFs in the future. However, it’s fine – and a good approach – to just stay the course for now.

Last updated on February 23, 2022

3 replies on “Future accessibility of US domiciled ETFs for Swiss investors”

Hey thanks a lot for this post. Its very informative and a good overview in this mess of information floating around.

Super helpful article, thanks a lot!

That is a problem of course.

Guys, can you tell me what are you doing to compensate this disavantage ?

Would it be intelligent to buy swiss domiciled etf for tax efficiency ? (eliminating L2WT).

Thank you