Is your investment strategy clear? Do you have a long investment horizon? Are you confident that you have the risk tolerance to invest in equities? If the answer to these questions is yes, you’re ready to choose your equity ETF funds. This entry aims to help you find the right ones.

Before you start

This entry is limited to the choice of equity ETFs. It assumes that equities are a right investment for you. How can you know? The choice of asset class depends on your capacity to invest, your risk tolerance and your investment horizon. If this is unclear to you, you should start by checking this investing 101 entry. If you’re interested in bond ETFs, you should check this other entry.

Investing in US domiciled funds

US domiciled funds offer a series of advantages. Whether they make sense to you or not depends on the country you live in.

Swiss residents

US domiciled funds are a superior alternative for Swiss residents. The reasons are listed in this entry

The main drawback of US funds is that they trade in US dollars. Buying them implies accepting currency risks. But don’t fool yourself. Even if you didn’t invest in US funds you’d still be exposed to a great deal of currency risks. For starters, the base currency of many funds is USD. Even if they trade in CHF or EUR.

Even if you currency-hedge, you’re still exposed. Why? Because any big company you buy earns revenues in multiple currencies. FX rates affect their revenues. Their revenues affect their stock price. More info on the topic of currency risks here.

Non-Swiss residents

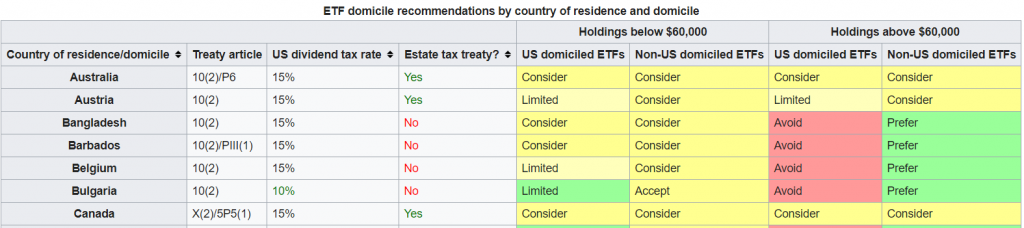

Depending on your country, US domiciled funds might or might not make sense. If you don’t know yet, this bogleheads entry is a neat starting point.

US domiciled funds

Does it make sense for you to invest in US domiciled funds? Are you comfortable with it? If so, the natural next step is to narrow down interesting US funds to invest in. Vanguard has something to say.

What is Vanguard?

Vanguard is a US ETF provider. The second-largest ETF provider in the world as a matter of fact (after iShares). I personally really like Vanguard because of its strong low-cost mantra. It’s also different from other providers in that the company is owned by its own funds. “Its clients are also its owners” [1].

In case you want material for due diligence, other major US ETF providers are BlackRock’s iShares, SPDR, and Invesco PowerShares. You should be able to easily find alternatives to most Vanguard funds.

Popular Vanguard ETF funds

So now you know what Vanguard is. What does it have to offer? Let’s look into some of Vanguard’s most widely traded equity ETFs:

Last updated on February 29, 2020, # stocks and net assets are rounded

| Ticker | Fund name / tracking index | Regions | # stocks | Cap focus | TER | Net assets, $bn |

|---|---|---|---|---|---|---|

| VT | Total World Stock | World | 8,400 | Large, mid | 0.08% | 13 |

| VTI | Total Stock Market | US | 3,600 | Large, mid, small | 0.03% | 130 |

| VOO | S&P 500 | US | 500 | Large | 0.03% | 130 |

| VEA | FTSE Developed Markets | Developed ex-US | 4,000 | Large, mid, small | 0.05% | 74 |

| VXUS | Total International Stock | World ex-US | 7,400 | Large, mid, small | 0.08% | 19 |

| VEU | FTSE All-World ex-US | World ex-US | 3,300 | Large | 0.08% | 24 |

| VWO | FTSE Emerging Markets | Emerging markets | 5,100 | Large, mid, small | 0.10% | 62 |

A few remarks on the table:

- All ETFs have extremely low TERs and are huge in terms of net assets

- Each ETF by itself already offers an extremely high degree of diversification

- VT tracks a world index representative of the total equity world market

- VTI and VOO are US-only funds. VOO tracks S&P 500. VTI includes also small- and mid-cap. They are the biggest funds by net assets

- VXUS and VEU are world ex-US funds. VXUS includes small- and mid-cap. VEU doesn’t

- VEA and VWO consists also of non-US stocks. VEA covers developed markets only. VWO covers emerging markets only

To emphasize: the list on the table above is by no means exhaustive. For starters, it covers just equity ETF funds. I encourage you to explore other ETFs on Vanguard’s website.

Remember: ETFs != mutual funds

For many funds, Vanguard offers both an ETF and a mutual fund version. For example, the mutual fund alternative to VTI is VTSAX. I personally recommend sticking always to the ETF version. Compared to mutual funds, ETFs:

- Have lower TERs: Vanguard mutual funds are cheap, but ETF funds are still the most cost efficient option

- Charge lower transaction fees: buying and selling liquid ETFs is inexpensive. Especially if you have the right broker. With Interactive Brokers, you can transact $50k and pay $2 in fees

- Have a higher trading frequency: ETFs can be bought and sold throughout the trading day. Mutual funds typically only trade once per day

You can find a full list of differences between ETFs and mutual funds here.

Non-US domiciled funds

Do you live in a country that makes it sub-optimal to invest in US domiciled funds? Luckily there are still good options. The following funds are alternatives to VT domiciled in Ireland. They’re a good option for EU investors.

| Ticker | Fund name / tracking index | Regions | Type | # stocks | Cap focus | TER | Net assets, $bn |

|---|---|---|---|---|---|---|---|

| VWRL | Vanguard FTSE All-World | World | Distributing | 3,400 | Large, mid | 0.22% | 4 |

| VWRA | Vanguard FTSE All-World | World | Accumulating | 3,400 | Large, mid | 0.22% | 0.1 |

| VT | SPDR MSCI World | World | Accumulating | 1,600 | Large, mid | 0.12% | 0.1 |

These ETFs trade in multiple currencies, including EUR and GBP. Remember that, regardless of the trading currency, the currency risks are exactly the same as investing in a fund that trades in USD. This is because the base currency of all these funds is USD. We explained how it works here.

If you want to learn about more interesting non-US funds, you should check this out.

How do I choose my ETF funds?

We have a list of funds. It should be easy from here: which one do we choose? Well, some basic investing principles are diversification, fees minimization and tax optimization. But this doesn’t help, since all funds above are strongly diversified and very efficient both in terms of fees and taxes.

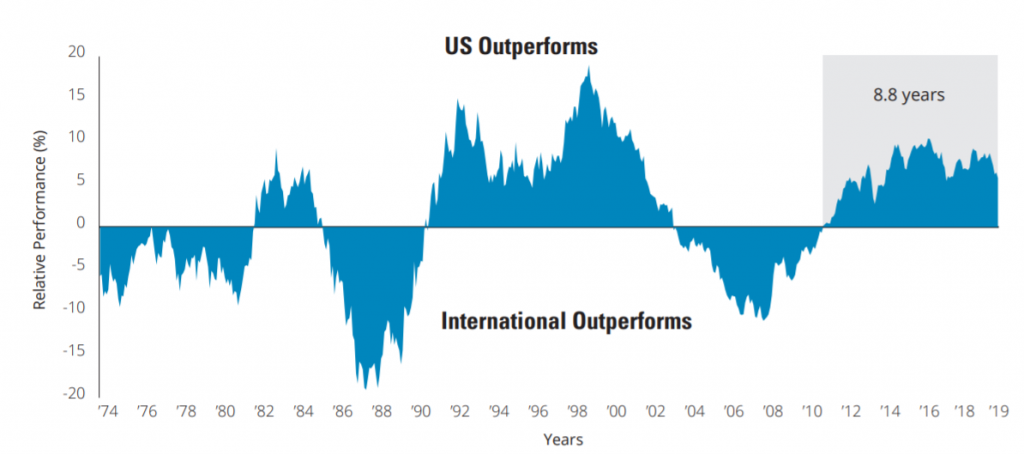

There are other investing considerations that could set some funds apart, but they are more disputable. For example, US stocks have outperformed international stocks since the 2008 global financial crisis [2]. Should you overweight US stocks vs international? Or is this trend set to reverse? Speaking about international stocks, will emerging markets provide better returns than developed markets? Or is the golden era for emerging markets over? What about market cap? Will I get better results if I invest in large cap only?

There’s no definite answer for any of these questions. You’re a Google search away from thousands (of thousands) of different views from ‘experts’, pundits and the like. They’ll definitely help you second-guess yourself and make you constantly think about lucrative strategies that aren’t. But I’m skeptical how much they’ll help you outperform the market long-term.

Unfortunately, there is no silver bullet when it comes to the choice of fund

No one who thinks about investing seriously has a definite answer as to which equity funds are best to hold long-term. Because of that, a common approach is to baghold most of the world equity market. This can be done with a single fund or with combinations of funds.

Common Vanguard US domiciled portfolios

The following are common Vanguard portfolios. Take them with a grain of salt. There’s funds other than Vanguard’s. And there’s opinions other than mine. To try to contain any personal bias, I’ll also include links to bogleheads discussion posts on the topic. I encourage you to form your own opinion.

- VT only: this is the ultimate lazy portfolio. Buy-and-forget. No need for rebalancing, no need to make choices. It’s heavily skewed to the US (~55-60%), but that’s simply because that’s the reality of the world equity market [3, 4]. A very interesting choice for those who just want to go on autopilot (and have the psychological discipline to do so). All non-US funds in the table above are equivalent to VT

- VTI + VXUS: a simple, two-fund allocation. You can fine-tune US vs non-US exposure. Even more fee-efficient than VT (TER of 0.03% vs 0.08%). Keep in mind, though, that the expense optimization curve is very flat at this point – it’s just 5bps. It has even more stocks than VT alone. On the downside, you have to make choices around % allocations and potentially rebalance your portfolio periodically. An idea for % allocation could be 60-40, replicating the world equity market. 75-25 is also common

- VOO + VXUS: same as above but with no US small- and mid-cap stocks, in case you despise them for some reason

- VTI/VOO + VEA: in case you don’t trust emerging markets

- VTI/VOO + VWO: if you love emerging markets

- Just VTI/VOO: U-S-A! U-S-A!

Below some discussion posts from bogleheads.org. Keep in mind that most bogleheads users are American and write from an American perspective:

- Single fund (VT) vs two-fund (e.g. VTI + VXUS) portfolio [5, 6, 7, 8, 9]

- VXUS vs VEA vs VEU vs VWO [10, 11, 12, 13]

- VTI vs VOO [14, 15]

- US vs international stocks [16, 17, 18, 19]

The curse of choice and keeping perspective

You won’t find a definite answer as to which are the optimal funds to buy. Having to make a choice can cause anxiety, because you may make the wrong choice. Keep things in perspective. If your main concern around your personal finances is whether to baghold VOO or VTI, then you’re surely ahead of most. You’ve already worked on a budget that allows for regular investments (hopefully, otherwise focus on this first). You know your investment horizon and understand your risk tolerance (hopefully, otherwise focus on this first). You are even already optimizing for taxes and expenses by choosing a US domiciled fund. Chances are you’ll be fine. Form an opinion, start buying your funds, and stay the course.

Last updated on May 23, 2020

5 replies on “Choosing your ETF funds”

Hi. First a huge thanks for your site! Obviously much hard work has gone into it. The sharp writing and clear action-oriented advice are outstanding. Really helps navigate what is a complex, intimidating topic to us lay people. Thanks to this, I am finally taking up investing (better late than never…)

The fund-combination suggestions on this page are super helpful as I ponder portfolio composition.

A few questions:

I get that there are no definite, right answers on this. But I’d love to know your own personal opinion on the key tradeoffs as a Switzerland-based expat (which I am also), looking at it at this point in time:

– How do you think about the relative merits of these options? (The Bogleheads links are only partially helpful, being very US and US-retirement-funds focused)

. Notably option 1 vs 6 vs 2/3?

. And what would be reasons to avoid small/mid cap in US in option 3?

. And how to think of VXUS vs VEA ?

– What did you in the end decide for your own portfolio, and why?

– For someone like me who is going to get in big this year, how does the possible lack of access to US ETFs come Jan 2022 affect this choice? (I assume rebalancing will then have to happen with non-US ETFs, even if we can still keep our US ETFs bought before 2022 – does that then make option 2, eg, messier than option 1?)

Thanks!

Hi David, glad you enjoyed the content! :). Some answers to your questions:

* Personally I tend to recommend option 1 for simplicity. I personally follow option 2 for legacy reasons, but honestly I think the difference with 1 would be negligible in my case (both in terms of exposure, given my % allocation, and TERs)

* No particular reasons from my side to avoid small/mid cap. Some people prefer blue chip because “they know those companies”

* I prefer VXUS (rather than VEA) because I don’t have any bias against small/mid cap

* In my view the potential loss of access to US ETFs in 2022 doesn’t change anything. It is financially optimal at the moment is to invest in US domiciled ETFs. It seems that in any event you’ll be able to keep what you’ve already bought. So buying these ETFs for as long as we can only makes sense

hi

Newbie here, thanks for this great blog in general and the excellent blog post in particular. I am thinking on getting started with strategy 1 i.e. buying just one global ETF. If in addition I buy a 3a pillar (for example with viac, where you can allocate your portfolio to global, swiss, etc), what would be your recommendation on what to allocate that portfolio to? global again as anyway this is the most diversified, or better not replicate my main investing and better do something different there like swiss etc?

And another question: If I buy global to get started, but later I am interested on investing on a more specific ETF, let’s say small cap, is that fine? I was reading that one should avoid ETF overlap …

thanks!

Hi Otto. There’s no “right answer” to that question, but a whole discussion is presented in the section “common Vanguard US domiciled portfolios” of this very post 🙂

Thank you so much for this post, it’s easily the best ETF guide I’ve come across!

1. In the “Non-US domiciled funds” table, I think the “SPDR MSCI World” fund has the wrong ticker. It also links to the Vanguard website which I don’t think is correct either.

2. I have a question about rebalancing your ETF portfolio. Suppose you decide to maintain a portfolio consisting of both VTI and VXUS, roughly evenly split between the two. I can think of three strategies for continuously investing your salary into your portfolio. A) You always buy whichever fund you have the least of (by value) B) You always buy an equal amount of VTI and VXUS (by value) C) You always buy VTI and VXUS in the same proportions as your current portfolio (by value). What’s the best strategy here? Using strategy A would usually result in buying the fund that has has performed worse than the other one since the previous rebalancing. Would that result in a higher return over time since you’re buying the discounted fund (on average)? If so, that seems like an argument to prefer VTI + VXUS over VT. Or is the expected return identical since a period of poor relative performance isn’t correlated with a subsequent period of good relative performance?