Pillar 3a is one of the most popular investments for Swiss residents. In fact, it’s somewhat unpopular not to contribute to pillar 3a. In this entry, we’ll discuss how pillar 3a works. We’ll also review the biggest pros and cons of pillar 3a investments, as well as some important investment considerations.

About this entry

There’s hundreds of websites out there explaining how pillar 3a works. Unfortunately, most of them are from pillar 3a providers. They have all incentives in the world to convince your of the benefits of opening your pillar 3a account with them today. In this entry, we’ll look at pillar 3a a bit differently. We’ll take the perspective of an investor that knows there are many alternatives out there (e.g. equity ETFs and bond ETFs) and wants to know if pillar 3a is competitive.

How pillar 3a works – the basics

Let’s start by reviewing the basics of pillar 3a.

What is pillar 3a

Pillar 3a is private pension plan. It complements pillar 1 (social security) and pillar 2 (employer pension plan) of the Swiss pension system. Unlike pillars 1 and 2, pillar 3a is voluntary. The goal of pillar 3a is to increase the retirement savings of Swiss residents. It does so by offering tax advantages.

The lock-up period

The money you invest in pillar 3a gets locked up. You can only access it 5 years before your legal retirement age (think 60+). However, you can cash out early in any of the three following cases [1]:

- You’re leaving Switzerland permanently

- You’ll use the money to buy a house as a primary residence. In this case, partial withdrawals are allowed

- You’ll use the money to fund a new business. In this case, partial withdrawals are not allowed [2]

Maximal contributions

There’s a yearly limit to how much you can contribute to your pillar 3a. This limit depends on whether or not you make payments to pillar 2 [3]:

- If you contribute to pillar 2, the pillar 3a annual limit is CHF 6,826. This is the case for most people. If you work for a company as an employee, chances are you fall in this bucket

- If you don’t contribute to pillar 2, your annual limit is CHF 34,128 or 20% of your income. Whichever is lower

These limits slowly increase with time. To compare, the max contribution in 2005 for the first case was CHF 6,192.

In case you’re wondering, you can’t make retrospective payments for previous years.

Investing in pillar 3a

You can’t invest in pillar 3a yourself. Instead, you have to invest through a pillar 3a provider. What does adding intermediaries always bring along? Additional fees! There’s dozens of pillar 3a funds out there to choose from. Make sure you go for those that offer the lowest fees. We’ve seen already than in the long run it makes a huge difference.

Pillar 3a and taxes

OK, the basics are clear. Let’s now get to the juicy part: taxes.

You likely knew that there are tax benefits linked to pillar 3a before you opened this entry. But you might not know all the specifics. Let’s bring some structure to it. There are four tax considerations around pillar 3a you care about:

- Tax deduction on pillar 3a investments

- Taxes dividends & interest of your pillar 3a portfolio

- Wealth tax on pillar 3a investments

- Withdrawal taxes for pillar 3a

Let’s cover the details of each.

1. Tax deduction on pillar 3a investments

This is the tax benefit of pillar 3a you often hear about. Contributions to pillar 3a are tax deductible [4]. If you don’t understand 100% how tax deductions work, check this entry.

What does that mean for you? Assume you max out pillar 3a investments to CHF 6,826 per year. Also assume that your marginal income tax rate is 30%. This is a rough estimate of the marginal rate for taxable incomes of ~120k. With these assumptions, you’d save ~2k per year in taxes by deducting pillar 3a investments from your taxable income. That’s not bad.

To synthesize, you immediately make a return on your yearly pillar 3a contributions equal to your marginal income tax rate. The problem is that the money is then locked.

2. Taxes dividends & interest of your pillar 3a portfolio

You pay no income tax on interest or dividends received as part of your pillar 3 investments [5, 6]. This benefit of pillar 3a is often neglected. Which is a mistake, because the savings are in the order of magnitude of the tax deductions. At least for a equity-heavy allocation and a long enough investment horizon (say ~25 years).

Just check some easy math: dividend yields currently sit at ~2%. With a marginal tax rate of 30%, that’s equivalent to ~60bps TER savings per year.

Besides, if you’ve read this entry on tax optimization, you’ll know that US withholding taxes can be an issue too. With pillar 3a, these are reduced to 0% as well [7], which is equivalent to ~30bps.

So if you were not optimizing for US taxes, the total tax savings compared to regular investments can get close to effectively to ~60-90bps TER. That typically compensates for the higher TER of pillar 3a solutions versus, for example, Vanguard funds.

3. Wealth tax on pillar 3a investments

You pay no wealth taxes on your pillar 3a investment portfolio [8]. Wealth taxes in Switzerland are quite low, but this will still make a difference if your pillar 3a nest gets big.

Let’s illustrate with an example. Assume that you’ve max out pillar 3a contributions for the last 15 years. That’d make for a pillar 3a portfolio of CHF ~100k. But let’s be generous and say it appreciated to 150k. Also assume you have total assets worth 1m. This brings your marginal wealth tax rate to ~0.3% in canton Zurich (see this post). With these assumptions, you’d save CHF ~450 per year in wealth tax.

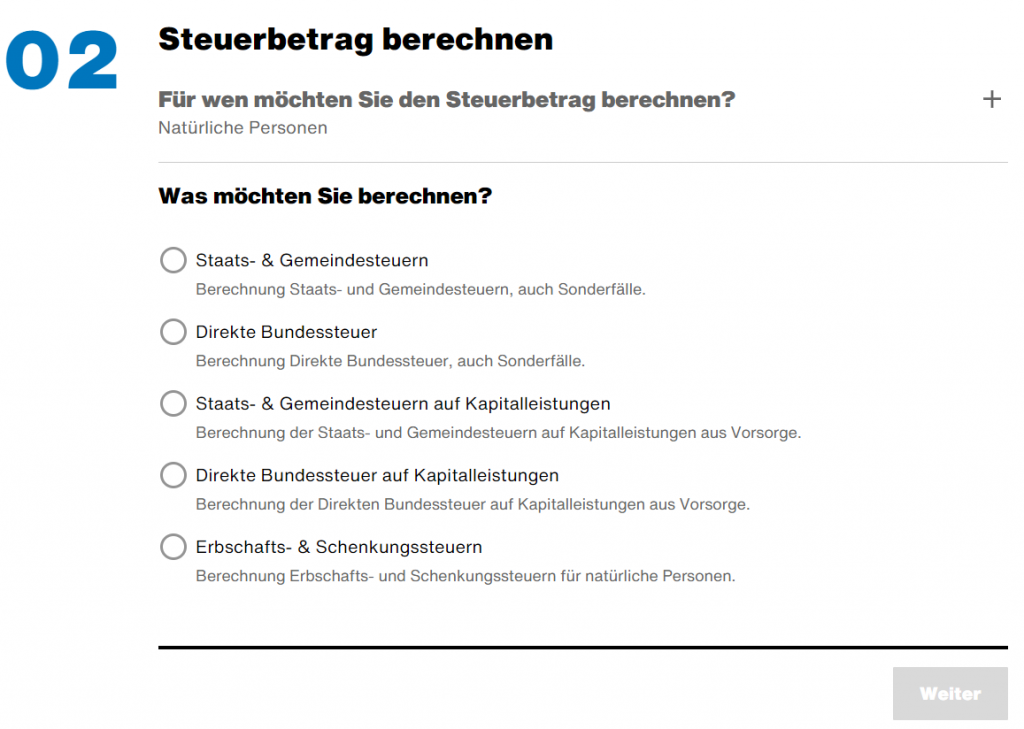

4. Withdrawal taxes for pillar 3a

You pay taxes on your pillar 3a portfolio when you cash out [9]. This often doesn’t get much attention, but it’s an important consideration.

The taxes you pay when you cash out your pillar 3a are separate from your income. They’re referred to as taxes on Kapitalleistungen and are lower than income tax.

Same as income taxes, you pay taxes on Kapitalleistungen to the federal government, the cantonal taxes, and the municipality. In canton Zurich, the tax office offers a handy tax calculator on Kapitalleistungen. You can find it here.

For the municipality of Zurich (assuming single, no church) taxes on Kapitalleistungen look like this:

You can download raw data for different marital status and confessions from the link. All data comes from the calculators of the Zurich tax office quoted above.

The tax benefit of having multiple pillar 3a accounts / portfolios

Having more than one pillar 3a account / portfolio is a well recognized strategy to save money on taxes. Why? Because, as we just saw, taxes on Kapitalleistungen are progressive. Cashing out all at once results in you paying more taxes than cashing out multiple times.

Every single pillar 3a account or portfolio has to be cashed out all at once. So the solution for a sequential cash out in different tax years is having multiple accounts. Most pillar 3a providers allow to do just that. You can find more info on the topic here.

Let’s look at an example. Imagine you have a total of 600k in pillar 3a investments. You can afford to cash out progressively. Getting the data from the chart:

- If you cash out all at once, you’d pay ~12.5% total taxes. That’s ~75k

- If you cash out 4 x 150k from four different accounts on different years, you’d pay ~5.4% for each withdrawal. That’s ~32k in total. Or around half what you’d pay cashing out all at once

Keep in mind that staggered withdrawals are not always an option. You’ll have to withdraw everything at once if you are moving out of Switzerland or triggering an early withdrawal to fund a new business.

The benefits of pillar 3a

Let’s aggregate the benefits of investing in pillar 3a. It’s all based on what we’ve learned already.

Tax, tax and tax

This is the main reason why pillar 3a is popular. We’ve already seen the different tax benefits. In order of importance, you benefit from:

- Income tax deductions

- No taxes on dividends or interests received

- No wealth tax

Enforcing discipline

This is a relatively minor benefit. For certain people, the forced lock-up period of pillar 3a investments might actually be a good thing. Do you have the discipline to keep a long investment horizon? If you don’t, pillar 3a might help establish good investing habits.

Diversification

Another minor benefit. If you’re the kind of person who concentrates all investments into a single broker (e.g. IB), a pillar 3a account could help diversify away risks broker risks. These could be black swan events such as compliance misunderstandings or cyber attacks.

The drawbacks of pillar 3a

Fees are high

You can only contribute to pillar 3a through a pillar 3a provider. The fact that you need them puts pillar 3a providers in a superior position to charge higher fees to customers. Even though there’s some competition between different providers, fees are still quite high. Normally in the range of ~1% per year. This is a lot. We saw that investments in equity ETFs have fees of ~0.05%. And we know that differences in yearly fees result in huge differences over the long run.

You lose control over your asset allocation

You’re normally not free to choose the asset allocation of your pillar 3a portfolio. There are legal constraints around a minimum percentage of domestic/CHF investments or maximum equity exposure [10, 11, 12]. This typically results in sub-optimal asset allocations. Examples are home bias, CHF hedged ETFs (which are expensive) or a bond-heavy allocation.

There are ways around it. For example, some pillar 3a providers pool everyone’s money and just ensure that the constraints are met at a fund level. Individuals can deviate if their deviations are offset by others.

In any event, pillar 3a investments won’t ever give you a 100% free asset allocation.

Your money gets locked up

We already saw that pillar 3a contributions get locked up. Fine, you can still withdraw under three different scenarios, but losing flexibility is always bad.

Pillar 3a doesn’t scale well

Even if you absolutely love the benefits of pillar 3a, there’s only so much you can contribute to your pillar 3a. The maximum contribution of CHF ~7k per year might fall short for some investors. And there’s nothing you can do about it. In other words, pillar 3a investments don’t scale up well.

Investment considerations for pillar 3a

We’re now familiar with how pillar 3a works, its benefits and its drawbacks. Let’s talk now about investing considerations.

The holy grail of pillar 3a investments

The main benefit of pillar 3a is a variety of tax savings. One of its main drawbacks is the higher fees. Which economic effect dominates is crucial when considering pillar 3a as an investment.

The main question for pillar 3a investments is whether the tax savings offset the higher fees

Two of the tax savings (income deductions, no taxes on dividends) depend on your marginal income tax rate. A third tax saving (wealth tax) depends on your wealth tax rate. Wealth tax is in general low in Switzerland, so most of the time it’s your marginal income tax rate the one that will drive tax savings. For pillar 3a investments to make sense for you, your marginal income tax rate has to be high. How high? Well, high enough for the tax savings to offset the higher fees. Now that you know the basics of pillar 3a, you can head to this entry for a detailed analysis.

Pillar 3a and your investment horizon

We’ve talked long about the importance of having your portfolio aligned with your investment horizon. For pillar 3a investments, this is less of a concern. If your marginal income tax rate is high, pillar 3a will make sense regardless of your investment horizon. Let’s see why.

Short investment horizon

A short time horizon is very suitable for pillar 3a. Why? Because the pillar 3a tax deduction benefit is immediate. Imagine the extreme case in which you make a single pillar 3a contribution and are able cash out a year after. You’re guaranteed a return equal to your marginal income tax rate. This can easily be 25-30%. Not bad, uh? Even if it’s only on CHF ~7k.

Long investment horizon

Pillar 3a can also be a good in the long term. Basically, you need for the dividend & wealth tax exemptions to offset the relatively higher fees of pillar 3a investments. Is this possible? Yes. Will it always be the case? No. It depends on the fees, which in turn depend on the pillar 3a provider you choose. But if it works, the compounding effect will result in pillar 3a investments having superior long-term returns. In a future entry, we’ll explore under which scenarios (and with which providers) this is the case.

A word on other pillar 3a solutions

Everything discussed in this entry revolves around pillar 3a investment plans. Broadly speaking, there are two other ‘plans’ available: savings account and insurance. Combinations of multiple are also possible.

Savings account solutions make little sense. As we saw in investing 101, you’ll lose a lot to inflation in the long run.

Other pillar 3a schemes include insurance policies. I haven’t done much research into those, but my advice is to stay away from pillar 3a insurance schemes. There’s a bunch of cases reported on Swiss forums from people who inadvertently got into such schemes and are trying to get rid of them [13, 14 ,15]. Usually, they only manage at a big cost.

What you’ve learned

You likely had heard about pillar 3a before reading this entry. But hopefully your knowledge is more structured now. You’ve learned:

- What is pillar 3a and how it works

- Which are the four tax considerations around pillar 3a you should care about

- What are the main benefits and drawbacks of pillar 3a investments

- Which are the main investment considerations around pillar 3a investments

You’re now ready to get practical and decide whether pillar 3a makes sense for you personally. This entry will help.

Last updated on March 14, 2021

2 replies on “How pillar 3a works”

I am binge-reading your blog.

What is your source for backing up this statement: “If you pull any of the early withdrawal triggers (moving out, buying a house, new business) you’ll have to withdraw everything at once anyways.” As far as I know, this is not true. It wouldn’t make sense to force people to withdraw more than they need just to buy a primary residence or start a business. After all the main objective of the pillar 3a is to save for retirement. I didn’t find any statement about this on https://www.bsv.admin.ch/bsv/de/home/sozialversicherungen/bv/grundlagen-und-gesetze/gesetze-und-verordnungen.html

Hi aarhorn, glad you’re finding the blog interesting 🙂

Great question! I’ve looked into it and found that:

I updated the entry accordingly. Thank you so much for your contribution!