This is the second out of three entries of the tax declaration guide on tax deductions. We’ll cover:

- Out-of-pocket expenses for part-time jobs

Nebenerwerbskosten - Interests on debt

Schuldzinsen - Alimonies and pensions to others

Unterhalt und renten - Pillar 3a

Säule 3a - Insurance premiums

Versicherungsprämien - Work-oriented education/courses

Berufsorientierte Aus- und Weiterbildung

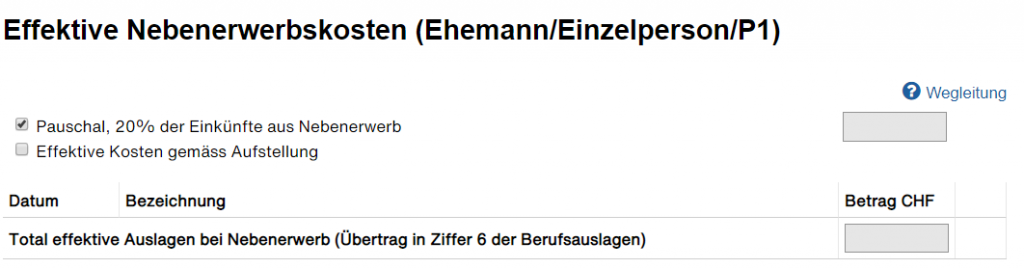

Expenses for part-time jobs

Nebenerwerbskosten

You can use this form to deduct out-of-pocket expenses for a part-time job. The two possible approaches are:

- Flat rate 20% of the income: no questions asked. According to the guidelines, the maximum possible deduction if you go for a flat rate is CHF 2,400. There seems to be a minimum of CHF 800 as well. I’m not sure if this is enforced. If it is, you’d need a minimum income of CHF 4,000 for the flat rate to work

- Actual costs: the manual option. Go for it if you think that your part-time job expenses are above 20% of the income. You’ll have to list all your expenses. Make sure you have the receipts ready if you go down this road. You’ll have to upload them

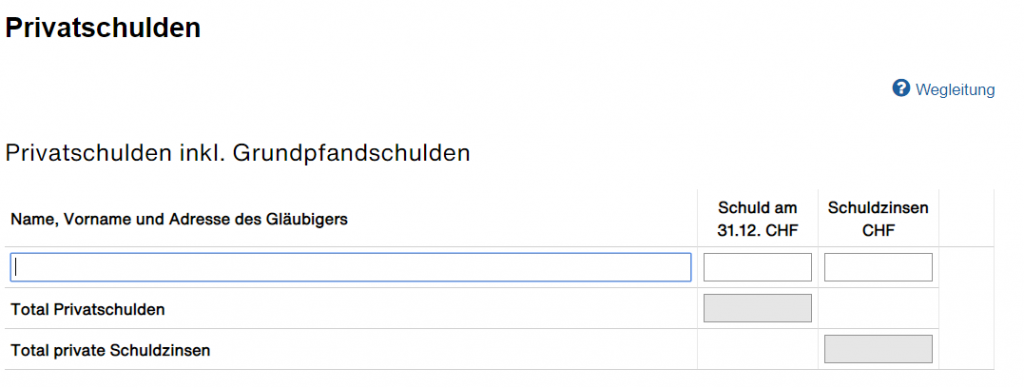

Interest on debt

Schuldzinsen

You can deduct interest payments using this form. Remember that you deduct interest paid on debt, not debt itself. Typical items you can deduct are loan interests or credit card interests.

Do you have a property with a mortgage? Then don’t use this form. You’ll have a chance to write the details of the outstanding debt and interests paid later under Vermögen.

If you made several interest payments during the year, list them separately. You must also indicate the outstanding debt of each item as of end of the tax year. Finally, remember that you’ll have to upload proof for the interest payments.

There are limits to how much interest you can deduct. Deductions on interest can’t exceed:

- Gross income from both movable and non-movable private assets. These are income from securities, real estate etc.

- CHF 50,000

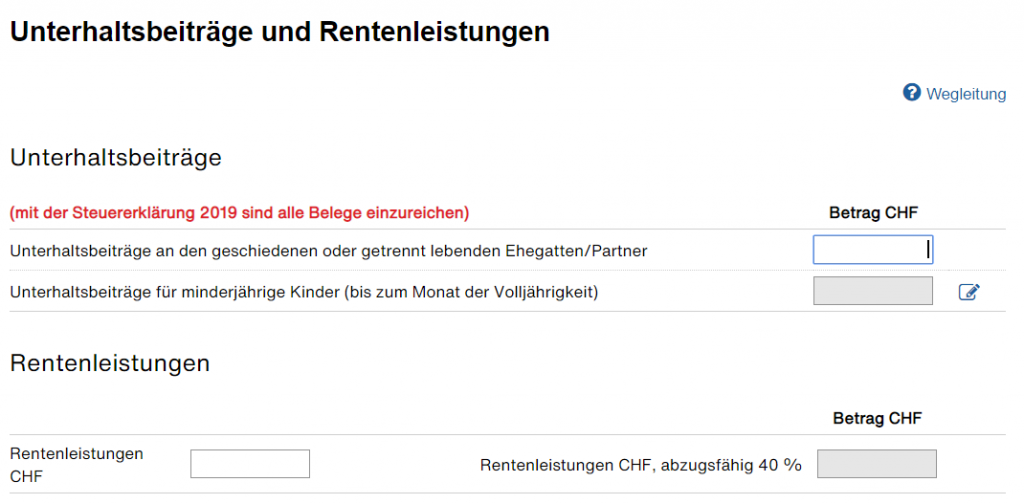

Alimonies and pensions to others

Unterhalt und Renten

You can deduct any potential alimony passed to a divorced or separated spouse/partner in full. This is the field Unterhaltsbeiträge an den geschiedenen oder getrennt lebenden Ehegatten/Partner. It requires uploading proof.

You can also deduct alimonies passed to children. This is the field Unterhaltsbeiträge für minderjährige Kinder. The deduction works up to (and including) the month when the child turns 18. We already covered this form in theme 1: Persönliches. Both forms are linked and share the data.

Finally, you can deduct 40% of pension benefits using the third field (Rentenleistungen). To do that, indicate the pension in full in the left box. The right box will automatically take 40% of it.

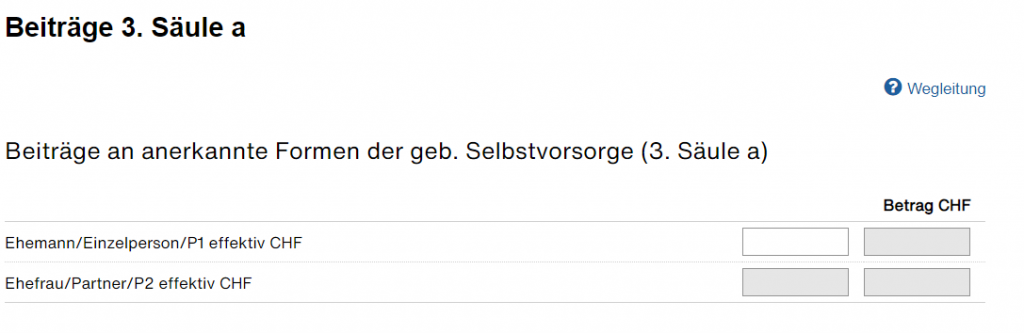

Pillar 3a

Säule 3a

Famous pillar 3a deductions take place here. For the tax year 2020, the maximum possible deduction is:

- CHF 6,826 if you have a pillar 2

- 20% of your income (capped at CHF 34,128) if you don’t have a pillar 2

These limits change from time to time. You can always check the latest from the BSV here.

By the way, all figures are per spouse (if applicable). And contributions must have been made in the respective tax year. You’ll also have to upload proof of pillar 3a contributions to the platform. All pillar 3a solution providers seem dedicated tax extracts for this purpose around Jan/Feb of the next year.

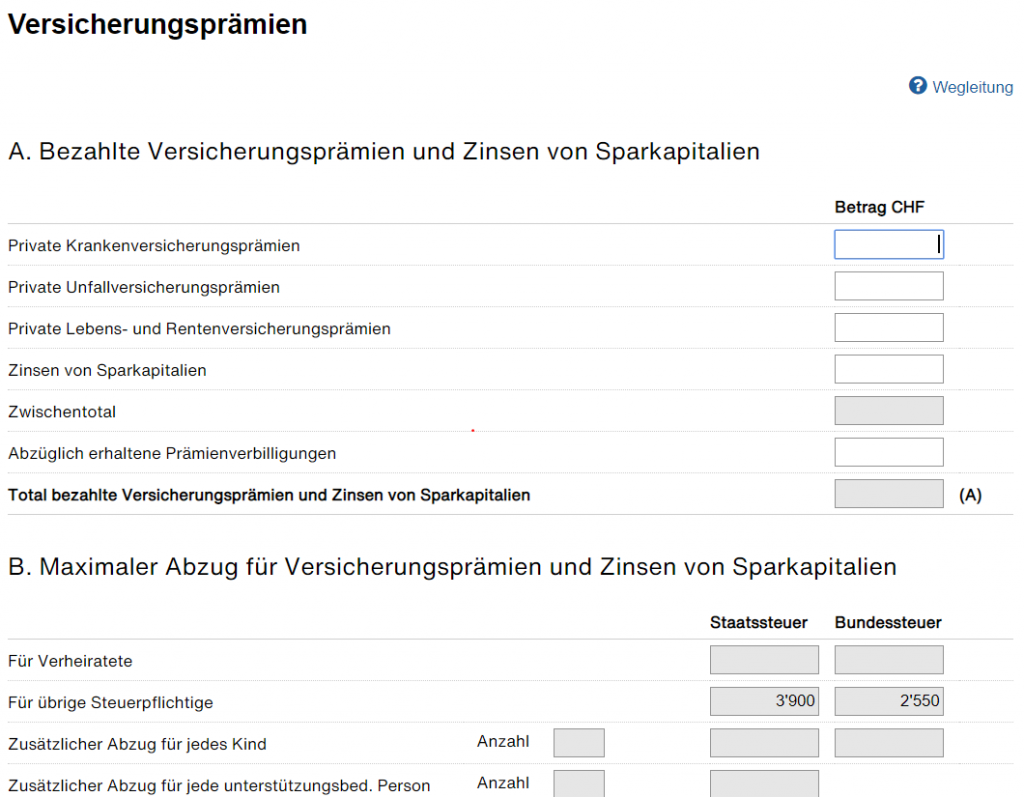

Insurance premiums

Versicherungsprämien

You can deduct certain insurance premiums using this form. It’s split into two parts.

Part A

In here you’ll find a bunch of types of insurances you can deduct:

- Health insurance

Krankenversicherungsprämien - Accident insurance

Unfallversicherungsprämien - Life and pension insurance

Lebens- und Rentenversicherungsprämien

You can deduct in all cases not only your own insurance premiums, but also those of children you maintain.

How to fill it in? Insurance companies send a yearly tax report stating the premiums paid. This report is typically sent around January for the previous year. Don’t calculate the insurance premiums yourself. Just wait for this doc. You’ll must upload such reports to the tax filing anyways.

On a separate note, you can also deduct interest received from your bank accounts in here. This is the field Zinsen von Sparkapitalien. I personally find this deduction quite weird. It’s likely it doesn’t apply to you. There’s a discussion around it here, just in case.

Part B

This section is automatically calculated. It caps your deductions to certain federal/cantonal limits. The caps are quite restrictive. As a result, your effective insurance deductions are almost always below your actual premium payments.

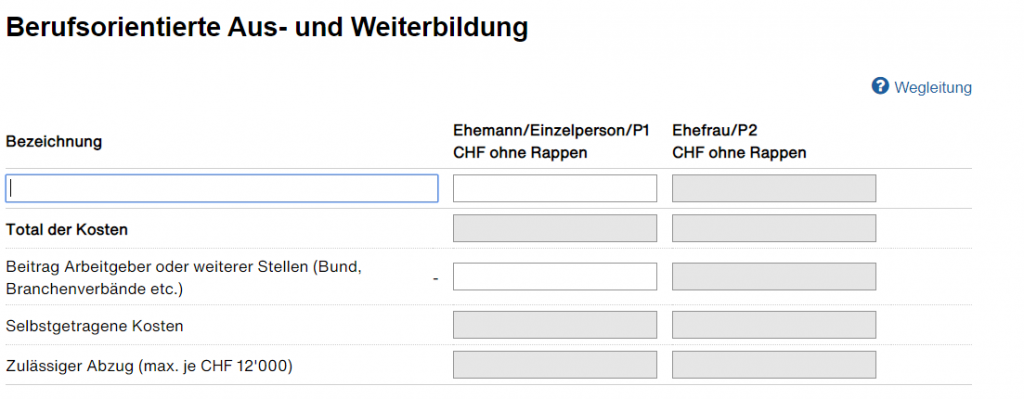

Work-oriented education/courses

Berufsorientierte Aus- und Weiterbildung

Use this form to deduct expenses for work-oriented training . You can deduct up to CHF 500 without supporting receipts. Make use of that limit!

Providing receipts, the cap is CHF 12,000. Going over CHF 500 requires uploading supporting docs. Deductions might include language courses, a coding academy, any kind of job training etc. In all cases, you must indicate if/how much of the total costs was borne by third parties. Third parties are typically employers, the federal government, industry associations etc. Aggregate all third party contributions in the field Beitrag Arbeitgeber oder weiterer Stellen. They won’t be considered towards the deduction.

Part three (and final) on tax deductions continues here.

Themes in the tax declaration guide

- Persönliches (personal data)

- Einkünfte (income)

- Abzüge (deductions)

- Wertschriften (securities)

- Vermögen (wealth)

- Abschluss (completion)

Last updated on March 13, 2021

4 replies on “Tax declaration guide (3/6): Abzüge [2/3]”

Hi, a tip for Work-oriented education/courses. You can deduct 500.- CHF without the need for any receipts. Enjoy :-).

Thank you for your input Manuel! I double checked with the Wegleitung zur Steuererklärung and you’re absolutely right! I’ve updated the entry 🙂

I think (but never tried yet), that it’s possible to deduct the ‘Bundessteuer’ as a ‘Debt’, since you get billed for it only in March of the following year and thus need to put money aside for that (steuerschulden).

Kanton BE mentions this explicitly (http://www.taxinfo.sv.fin.be.ch/taxinfo/display/taxinfo/Schulden).

Also https://www.suedostschweiz.ch/politik/konnen-steuerschulden-als-schulden-berucksichtigt-werden

Also https://www.vontobel.com/de-ch/impact/vermoegenssteuern-optimieren-der-tipp-mit-der-steuerschuld-25327/ (Quote: Wenn Sie die Steuererklärung 2020 erfassen, können Sie die direkte Bundessteuer 2020 als «Schuld» vom Vermögen abziehen.)

This one is interesting, thanks for sharing! It’s quite strong evidence to have so many sources pointing in the same direction.

I wonder how this would work in practice, though. I guess it might offer a wealth tax relief (debt decreases assets), not an income tax relief (as there is no real Schuldzinsen or interest on debt at play). If that’s the case, I’d expect the effect to be quite minimal, given typical marginal wealth tax rates.