You live in Switzerland, so it sounds natural to invest in Swiss securities. What is there to know before investing in Swiss securities? And how much should you invest anyways? Does it make sense to invest only in Swiss securities?

Image courtesy of swiss-group.com

An overview of Swiss securities

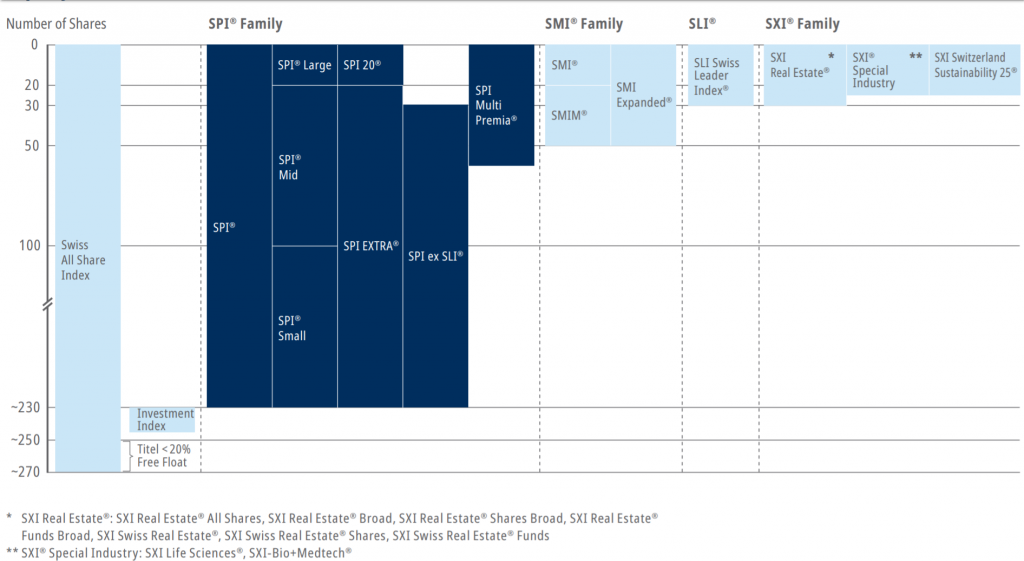

SIX indices provide a very good overview on the the Swiss securities landscape:

Swiss equity funds

The most famous indices in the pic above are arguably the Swiss Market Index (SMI) and the Swiss Performance Index (SPI). They’re quite different from each other, though.

SMI is a market-cap weighted blue-chip index. That’s a lot to chew. Market-cap weighted means that the weight of each constituent depends on how big that company is. The bigger a company, the greater its weight in the index. Blue-chip means that it tracks only big, well-known public companies. There’s not so many blue-chip Swiss companies. In fact, the SMI only tracks ~20 companies.

SPI is a broader index. Basically SPI = SMI + SPI EXTRA. This means that SPI fully encompasses SMI. But it also includes additional ~210 companies in SPI EXTRA. These additional companies are way smaller than those in SMI. Because SPI is also a market-cap weighted index, these additional companies don’t move the needle that much. As a result, SPI is not that different from SMI. The weight of SMI dominates. It eclipses almost totally the influence of SPI EXTRA.

The table below compares the three indices. Notice how SMI and SPI are heavily concentrated in few companies. SPI EXTRA is less so:

| Index | # constituents | Cap focus | Share of 5 biggest | Share of 10 biggest |

|---|---|---|---|---|

| SMI | ~20 | Large | ~66% | ~85% |

| SPI EXTRA | ~210 | Mid, small | ~19% | ~32% |

| SPI | ~230 | Large, mid, small | ~55% | ~70% |

SPI EXTRA has outperformed SMI/SPI since 1996 on a total return basis. Remember, though, that past performance is not an indication of future performance. Also see how correlated SPI and SMI are. The weight of SMI stocks in SPI is simply huge.

There’s other Swiss indices that cap the maximum weight of each company. This results in greater diversification. SLI is an example, if you’re interested.

Swiss bond funds

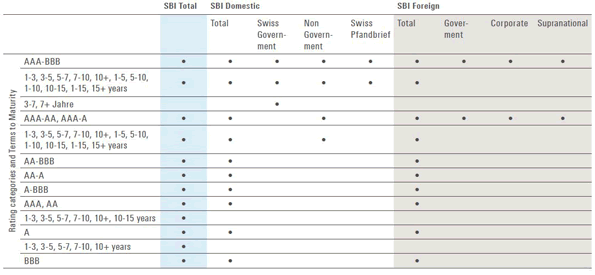

SIX also provides info on bond ETFs. You should check how bond ETFs work if you’re unsure how basket of bonds work.

At present, all Swiss government bonds have negative yields to maturity. I personally wouldn’t touch them with a 10-foot pole. You have to go for foreign corporate bonds to find a positive yield.

| Fund | # constituents | YTM (%) | Duration (years) | TER (%) |

|---|---|---|---|---|

| SBI domestic 1-3 | 3 | -0.65% | ~2 | 0.15% |

| SBI domestic 3-7 | 3 | -0.60% | ~5 | 0.15% |

| SBI foreign AAA-BBB 1-5 | 304 | 1.14% | ~3 | 0.20% |

How to invest in Swiss securities

You might think that the most efficient way to invest in Swiss securities would be through a Swiss broker. After all, they’re local players in the market. Who would know better about Swiss securities than Swiss banks and brokers? Wrong! Unless you want to be ripped off, stay away from Swiss brokers. And from all investment products that retail banks will offer you. Those 2% fees medium-risk funds won’t do any good to you. At least not compared to holding a low cost, well diversified ETF over the long run.

And that said, you probably shouldn’t invest that much of your money in Swiss securities anyways.

How much of your portfolio should be invested in Swiss securities?

Isn’t civilized-Switzerland posed to do better than other, more barbaric countries? Doesn’t it make sense to concentrate some exposure in Switzerland? No.

For starters, you might be surprised how much you’re exposed already to non-Swiss countries. Even if you invest solely in Swiss securities. This is because Swiss big corporates are truly multinational. The Swiss market is a tiny one after all. For example, let’s take Nestle. What percentage of Nestle revenues do you think are Swiss? It’s just 1.3% (double check my math here). If you buy Nestle, your exposure to the Philippines is literally more than twice your exposure to Switzerland. OK, fine. But what about Novartis? 1.8% (check here). Roche? 1.0%. And the three of them combined are already ~50% of the SMI index. And of the SPI index. Ugh…

Performance-wise, Swiss equities have underperformed US equities over the past 30+ years. Mostly because of the US outperformance in the last decade. But again, past performance…

Switzerland is a very stable, low inflation country. And an exceptionally good country to live in, if you ask me. But that doesn’t justify overweighting Switzerland in your equity portfolio. My recommendation is not to overweight Switzerland in your asset allocation. And to have an equity portfolio that replicates the whole world equity market instead. At the time of writing, that’s a weight of ~2.5% for Switzerland [1]. Find out more about recommended ETF funds here.

Overweight Switzerland – a caveat

The only reason I could imagine to go overweight Swiss securities is to avoid currency risks. We discussed currency risks here. If you’re absolutely 100% sure that you’ll spend the rest of your life in this country, then your tied to the CHF.

Unfortunately there are only two countries with CHF as the official currency. And the second one is not big enough to make a difference. So the only way to limit your FX exposure to foreign currencies is by holding Swiss assets. We’ve already seen that Swiss equities won’t do. Their revenues are too globally diversified. You’re left with Swiss real estate or Swiss bonds. And Swiss bonds currently suck.

Anyways, these alternatives might suit your portfolio well if you have a short investment horizon and you want to limit currency risks. If you have a long investment horizon, I’d argue that foregoing international markets is a mistake. Even if you plan to never leave the country.

Tax implications of investing in Swiss securities

Switzerland levies a withholding tax of 35% in income derived from Swiss securities [2]. This includes dividends from Swiss corporations, interest from Swiss bonds and income from Swiss collective investment schemes. To you, this means that should you expect to receive only 65% of Swiss dividend payouts. This is regardless of the broker you use. Doesn’t matter if your broker is Swiss or non-Swiss.

If you’re a Swiss resident, you can reclaim this tax during your tax declaration. You’ll have tougher luck if you’re a foreign resident. Remember, however, that you still have to pay income tax on the dividends/income received.

If you’re a Swiss resident, you’ll get back the 35% withholding tax on income from Swiss securities. You still have to pay income tax on them

To take an example, assume a Swiss company pays you CHF 100 in dividends. CHF 35 are withheld and only CHF 65 hit your cash account. If your marginal tax rate is 25%, you’ll get back (35% – 25%) * 100 = CHF 10 from the Swiss government.

Untangling the mess – Swiss securities and Swiss brokers

The implications of investing in Swiss securities are different from the implications of investing through Swiss brokers (discussed here). This table hopefully untangles the mess:

| Type | Swiss broker | Non-Swiss broker | ||

|---|---|---|---|---|

| Swiss security | Stamp duty 35% withholding tax | 35% withholding tax | ||

| Non-Swiss security | Stamp duty Additional 15% withheld for US securities (Steuerrückbehalt USA) | No Swiss withholding tax* | ||

* But maybe other withholding taxes depending on country

Closing words

The Swiss equity landscape is dominated by few companies. Nestle, Roche and Novartis account for ~50% of the main Swiss indices. Unless you have specific reasons for it, you shouldn’t overweight Switzerland in your equity portfolio. Don’t be afraid of international exposure. Big Swiss companies barely generate any revenue in Switzerland, so they’ll expose you to foreign markets and currencies anyways. And whatever you do, don’t invest through Swiss brokers.

The Swiss bond market is extremely unattractive at the moment. There is no reason to buy bonds with a negative yield to maturity.

Last updated on May 23, 2020