Are you ready to begin your investing journey? This entry is a step-by-step guide on how to buy your first ETF. You’ll learn how to avoid common pitfalls new investors face. You’ll also find out about best practices for every subsequent purchase.

Before you begin…

Many uninitiated investors make the mistake of jumping too fast to how-to-buy. Don’t be one of them. Buying securities online through a broker is easy. It’s like buying stuff on Amazon. You’ll get it done when you need it. The difficult thing is to make sure that what you’re buying is the right stuff for you.

In other words: the bulk of your effort shouldn’t concentrate on the operational aspects of investing (how to buy, which app to use etc.). It should concentrate on the fundamental ones. Which investment product is right for you? A good way to answer the question is to focus first on your capacity to invest, your investment horizon and your risk tolerance. If you haven’t thought of those, make sure you check this entry before you continue reading.

Choosing your broker

Let’s start with the basics: brokers.

Why do you need a broker?

Brokers are professional who execute buy or sell orders for securities on your behalf [1]. You need a broker to get your orders to an exchange. Don’t know what an exchange is? Find out here.

Make sure you trade online

Generally speaking, you don’t want a person to be your dedicated broker. And you also don’t want to have to call someone when you want to buy or sell. Why? Because that’s expensive. And you don’t want trading to be expensive. Instead, you should use an online broker. Online brokers are the most inexpensive and time efficient alternative to trade nowadays.

Which broker to use?

We covered the topic in this entry. The bottom line is that I recommend Interactive Brokers (IB) or Degiro. With a preference for the first one. But which one you choose depends on your ambitions.

Both IB and Degiro charge very low fees. IB’s fees are even lower. But it charges an account maintenance fee of $10 per month if your balance is below $100k [2]. That’s $120 per year. If you’re getting started and don’t plan to get to $100k anytime soon, this might be expensive.

On the other hand, Degiro doesn’t allow to buy US domiciled funds. IB does (for now, check this out). This is a strong point for IB. For Swiss investors, US domiciled funds are quite optimal. See why here. Once again, this might not be so important for you if you’re getting started. The tax advantages of US domiciled funds can only be claimed when you’re investing more than ~20k. Why? Find out here.

Whichever broker you choose, this entry will help you. We’ll cover certain specific details for both brokers.

First steps with your broker

The first step is to open an account with your broker of choice. This step is relatively trivial. However, there’s some stuff to keep in mind for either broker.

Degiro

Degiro’s websites has multiple local domains (e.g. .ch, .de, .nl etc.). At the time of writing, the your domicile is automatically linked to the domain you use. This means you should make sure you use the right domain. If you live in Switzerland, you should start here.

Degiro offers both a phone app and a web-based environment. Either is a good option.

Interactive Brokers

With IB there’s a single domain, so you can always start here. Your domicile will be set based on your the personal info you provide.

IB offers a phone app, a web-based environment and a desktop application called TWS. My advice is to use mostly the phone app. It makes things easier. You can use the web-based tool for more complex queries (e.g. getting tax info at year end). I wouldn’t use the TWS. It’s a complex environment that doesn’t bring any advantage to a passive, long term investor.

Once you have an account with either broker, you should transfer money. You can do this via a regular bank transfer. The steps are clearly described on either broker’s website. You can always withdraw money back to your bank account at zero fees.

What should you buy?

Did the money finally arrived to your broker account? Then you’re ready to buy your first ETF! Where to start? Well, it depends…

I’ll assume you’re a long term investor with a relatively high risk tolerance. This means that you can leave your money invested for 15+ years. And that you won’t freak out and panic-sell everything when markets crash 20%+. These are big assumptions. But if you’re comfortable with them plus you understand how stocks work, you may invest in equities. We reviewed a collection of top equity ETFs here. We also covered bond ETFs here and here.

If you feel like your profile is different, make sure you do your research before buying anything. Never buy something you don’t understand.

When is a good time to buy?

Say you already have a moderate stash of cash you want to invest. When should you buy? There are two accepted strategies:

- Lump-sum investment: this means investing as soon as possible. Typically all at once. Research suggests that, statistically, lump-sum investing provides the best returns [3]. However, lump-sum investing might be psychologically difficult to deal with. What if you invest all at once and markets go down soon after? If you feel you don’t have the risk tolerance to invest all at once, you shouldn’t.

- Dollar-cost averaging (DCA): DCA means spreading your investments over time. Statistically, it provides lower returns than lump-sum investment. But it’s psychologically easier for most investors. You should always define your DCA strategy in advance. And then commit to it. Whatever happens. For example, if you have $10k to invest, you might decide to invest $1k every Wednesday for two and a half months. You don’t change the strategy regardless of how markets move.

What you shouldn’t do is to wait until you feel it’s the right time to invest. Why? Because you’ll get it wrong. You’d be timing the market. Market timing will harm you a lot in the long run. Discover why here.

What time of the day should you trade?

There’s two things to consider when deciding what time of the day to trade.

The first consideration is that you can only trade a security when the exchange for that security is open. Exchanges are typically open from ~9am to ~5pm local time. Be aware of the time difference if you’re buying US domiciled ETFs. US markets only open at ~4pm European time.

The second consideration has to do with liquidity. We explained what’s liquidity here. Generally speaking, markets are most liquid when both European and American markets are open. That’s roughly 4-5pm European time Monday to Friday. However, this second consideration is relatively unimportant. Especially if you’re trading liquid products, which you most certainly are. The differences will be minimal. It’s good to know, but don’t lose sleep over it.

Handling currency conversions

It’s not enough to have money in your broker account to transact. You must have cash in the right currency. If you’re buying securities that trade in USD or EUR but you transferred CHF to your account, you need to convert currencies. How to do it? It depends on the broker.

Currency conversions with Interactive Brokers

IB currency conversion fees are extremely competitive. You pay 0.002% in fees [4]. That’s nothing. For reference, you pay 4 francs to convert 200k. Other brokers (ehem ehem, Swiss) would easily charge you 1k for that (0.5%). The minimum conversion fee with IB is USD 2, though. It’s this minimum fee that will apply to you most often.

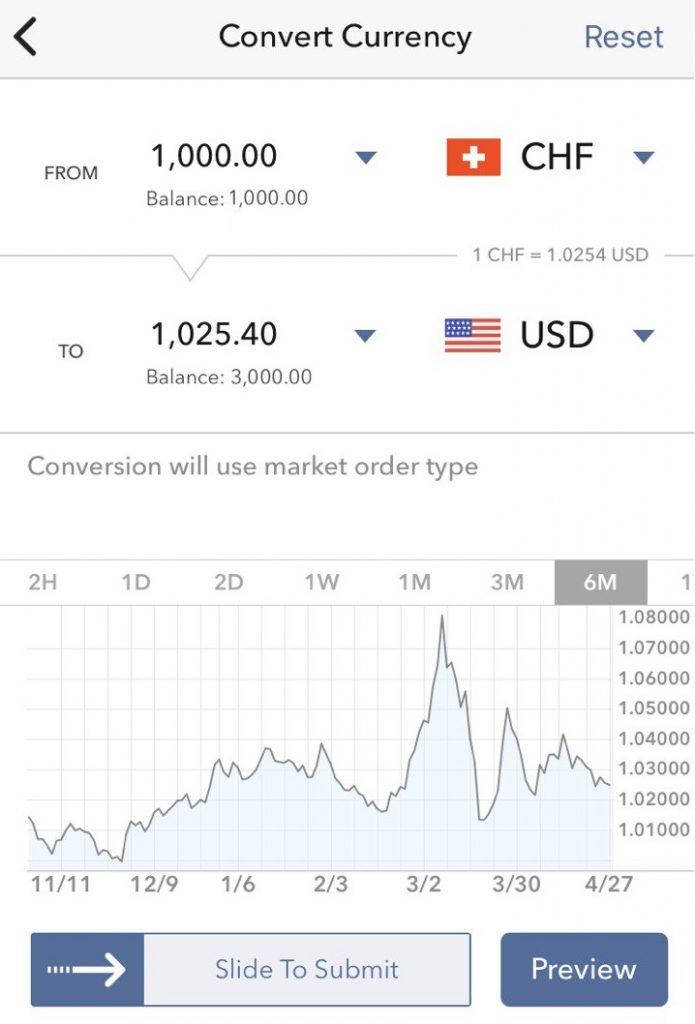

Update Oct’20: it seems like there’s an implicit fee (worse than actual exchange rate) when using IB’s “easy currency converter” on their mobile app. Or at least so I have observed at times. To avoid paying additional fees, I recommend to always buy currencies via buying / selling forex products. The steps are detailed below.

How to convert CHF into USD via forex with IB? You just have to follow the three steps below. You can adjust this for any other currency conversion.

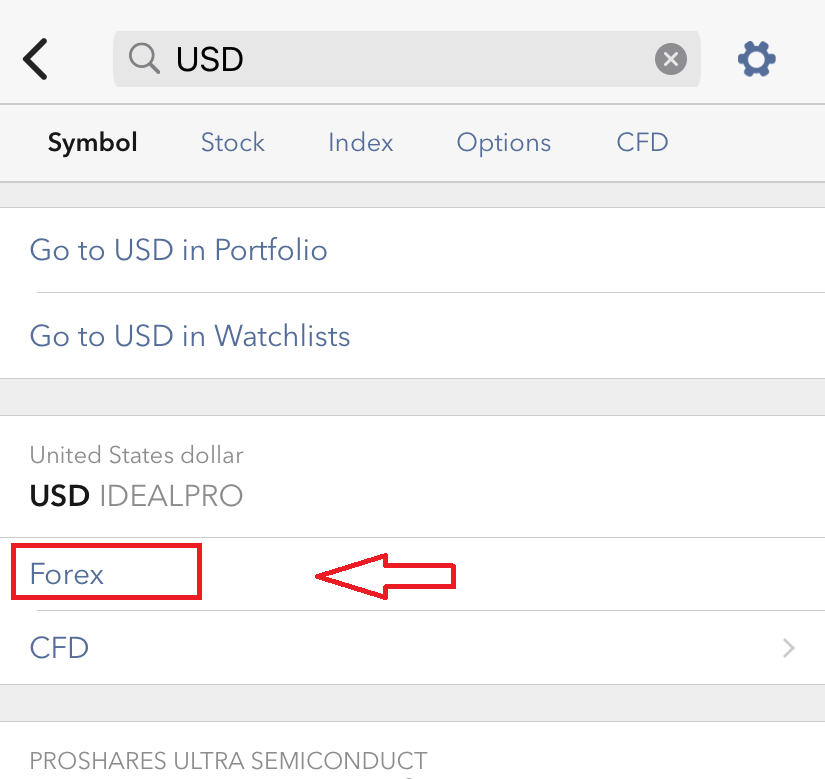

1. Find USD forex. Search for USD on the top bar and click on Forex:

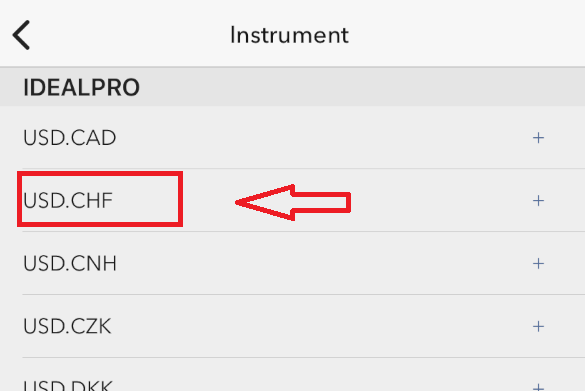

2. Select appropriate buying currency. This is likely CHF for you:

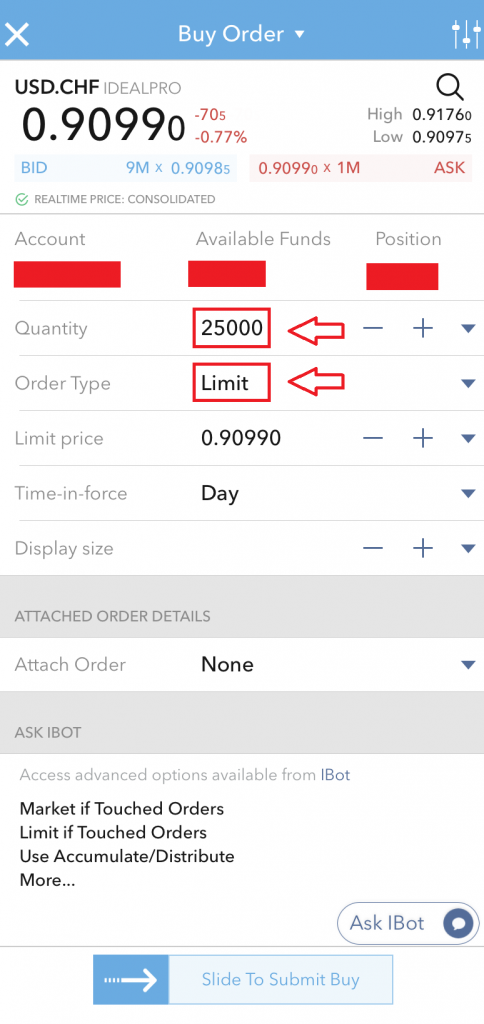

3. Choose how much USD to buy. We’re now on the Buy order screen. There’s only two things you should customize before submitting the order:

- Quantity: this is the amount of USD you want to buy. Remember that this is different from the amount of CHF you want to convert

- Order type: forex is a very efficient market, changing to market order is fine. More details on types of order in the next section

Currency conversions with Degiro

Converting currencies with Degiro can be done the hard or the easy way.

The easy way is to use Degiro’s auto FX trader. You don’t even have to think about FX with it. Currency conversions will take place automatically. The downside is that you pay 0.1% on it [5].

The hard way is to manually trade currencies. The fee in this case is EUR 10 + 0.02%. Isn’t it more expensive than using the auto FX? Depends on the amount. Solving for x in 10 + 0.0002 * x = 0.001 * x reveals that for conversions over EUR 12.5k the manual trade is cheaper.

Type of order

Markets are open. You have cash in the right currency. You’re ready to trade. The final obstacle is to submit an order to the exchange. Which type of order should you submit? We discussed in this post that entry that market orders make sense for liquids products. And liquid products is likely (and hopefully) what you’re trading. However, if you’re using IB, you should use mid-price orders for a more efficient execution.

Closing words

That’s it! You’re all set for your first ETF purchase. In this entry we reviewed:

- How to get started with a broker

- When to trade

- How to handle currency conversions

- Which type of order to use

This entry contains an unusually large number of link to other posts. That’s done on purpose. Why? Because most of the things discussed in this entry are rather operational. They’re not that important. Fundamental considerations are much more important. The linked posts will help you with those. I can’t emphasize enough how important is to understand (1) your investment constraints and (2) the financial products itself before you actually buy anything. There’s no way you’ll be a successful investor in the long run if you don’t.

Last updated on October 17, 2020

2 replies on “Your first ETF purchase”

Hi! Thank you for all the nice explanations!

I have a questions regarding converting currencies with Forex in IB. I believe that requires to have selected Forex CFD as a trading type (and be approved for it). Because otherwise I cannot find USD as you show in your screenshots.

And if I try to enroll for Forex CFD trading, it says my account should be Margin. Is this correct? Is it also a good idea for someone like me who just started on all this? Thanks!

Hey Javi! Glad you liked it! To your question, I don’t think CFDs are the only option to trade currencies. When I search for “USD” on the mobile app, I can choose between “Forex” and “CFD”.

I also don’t remember having asked for any specific account type to be able to convert currencies. Finally, no, I don’t think you’ll need a margin account to invest (leveraging up can always be risky!). Hope it helps 🙂